Personal Emergency Fund, building huge capital the easy way

Everyone needs a personal Individual Emergency Fund (IEM) to help take care of emergency needs. If you are planning to start a new business and need to raise the seed capital, in case you want to save towards marriage, school fees, or any other project that requires a lot of funds, then you will do yourself a disservice if you stop reading this along the line.

An Individual Emergency Fund is a fund you set aside to help you take care of all or some of the emergency financial needs as and when they come your way. It is a way of preparing for the unforeseen ahead of time.

Individual Emergency Fund emerges from the reasons for holding money. Economics tells us that, there are three (3) reasons for holding money. These include transactional, speculative, and Precautionary motives. The latter of the three is what your Individual Emergency Fund is to deal with.

Insurance is one way, by which we prepare for the unexpected, however, this write-up seeks to aid you with the knowledge and strategies needed to set up an Individual Emergency Fund which you can fall on when the need arises for your important projects.

Monthly Personal Emergency Fund Savings

When creating a Personal Emergency Fund (PEM) it is prudent that you estimate how much you need as a minimum in your fund as well as the amount actually needed to undertake the project for which reason you are operating this special fund.

The fund must be able to sustain you and help you meet your six months needs after a year of saving and investing the fund. We can call this the basic level.

The above implies having a fair idea of how much you spend on food, clothing, utilities, and transportation just a few to mention. If your expenses estimated are GHS500.00 a month, then you should build your Personal Emergency Fund to the tune of (GHS500 X 6 ) which gives you the range of GHS GHS 3000.00. Thus in one year, the savings alone should add up to GHS3000.00. This adds up to monthly savings of GHS250.00 a month.

Where to keep the Emergency Fund

The Personal Emergency Fund is as important as where it is kept. If you keep such a fund in a piggy bank or under your pillow or in any place in your room or with friends, you risk losing it. Such funds must be kept first in a bank account and separate from your regular bank account so you are not tempted to spend it as though it was meant for transactional reasons and erode the funds in the Emergency Fund.

A savings account may best fit the PEM but could also be operated in a current account but know that the latter will lead to bank charges which may erode your funds. The current new trend by banks is to even charge customers for drawing smaller amounts from their savings accounts. Hence avoid drawing funds from the account so you can build up the capital

It is now time to take a pen, paper, and calculator and do some brainstorming so you begin to plan and determine how much should be the minimum (PEM).

You cannot live a life without an emergency fund because unexpected challenges will come your way, and you have to take care of them. Start thinking of how to trim down your wasteful spending on daily basis and channel them into your fund.

Personal Emergency Fund helps provide an opportunity for you to save some cash against a rainy day. Your Individual Emergency Fund can be likened to the character of ants who work hard to save during the dry season, then remain hidden and still survive during the rainy season.

We have learned that we ought to know the minimum in our Personal Emergency Fund as well as where to keep the fund.

The next thing to know is that you have to build the PEM little by little through deposits. Little grains of sand make the beauteous land. Glow your fund slowly and not through huge monthly lump sums which will stress you up. This fund must not be touched until a minimum of six months however, the longer it takes to access the fund, the better. Think of interest-yielding instrument options from the money market.

Treasury bill which is simply loaning your excess funds to the government for 91,182 or 364 days at a fixed rate as well as mutual funds (a pool of funds collected from individual investors and invested by the mutual fund firm and the returns earned is shared among those who are participants) are recommended for you to invest your Personal Emergency Fund you build up.

Talk to your bankers about these to make the right choice. When you begin to fund your PEM, consistency in the amount deposited, say monthly, and how regularly the deposit is made is very important. If you are consistent, you end up creating an autopilot fund transfer into your PEM. However, the best recommendation is to let your bankers do debit transfers into your Personal Emergency Fund Account.

When you reach your target for the fund, you may have to do one of two things, re-access your basic needs to see if it has increased in money terms. If so, you may need to make a few more deposits or Stop funding the Personal Emergency Fund and allow it to earn the appropriate interest. Over-funding the PEM is not the best, if you still have to save each other month, think of doing a long-term investment.

Ensure that you are able to distinguish between what constitutes an emergency and what does not so that your emergency fund does not suffer what I call “Parasitic Spending” thus falling on the fund for every little thing.

It is important to put on record that the laid down facts in this article can be applied to take care of several plans and projects. Are you thinking of a degree or master’s program in a year’s time, marriage or building your own house, or even buying a parcel of land?

READ: Primary 3 pupil sets up reading foundation for street children

All these can be achieved through this simple but effective Individual or Personal Emergency Fund management system. Now you know the secret as to what the precautionary motive for holding money is all about and how to plan consciously for the unknown challenges and known challenges that need financial resources to deal with. Take the first step and act now!.

Image by Steve Buissinne from Pixabay

How to Buy Cheap MTN and AirtelTigo Data Online

How to Buy Cheap MTN and AirtelTigo Data Online  How to Download the iOS 18 on Your iPhone

How to Download the iOS 18 on Your iPhone  How to Check Ghana Civil Service Recruitment Application Status

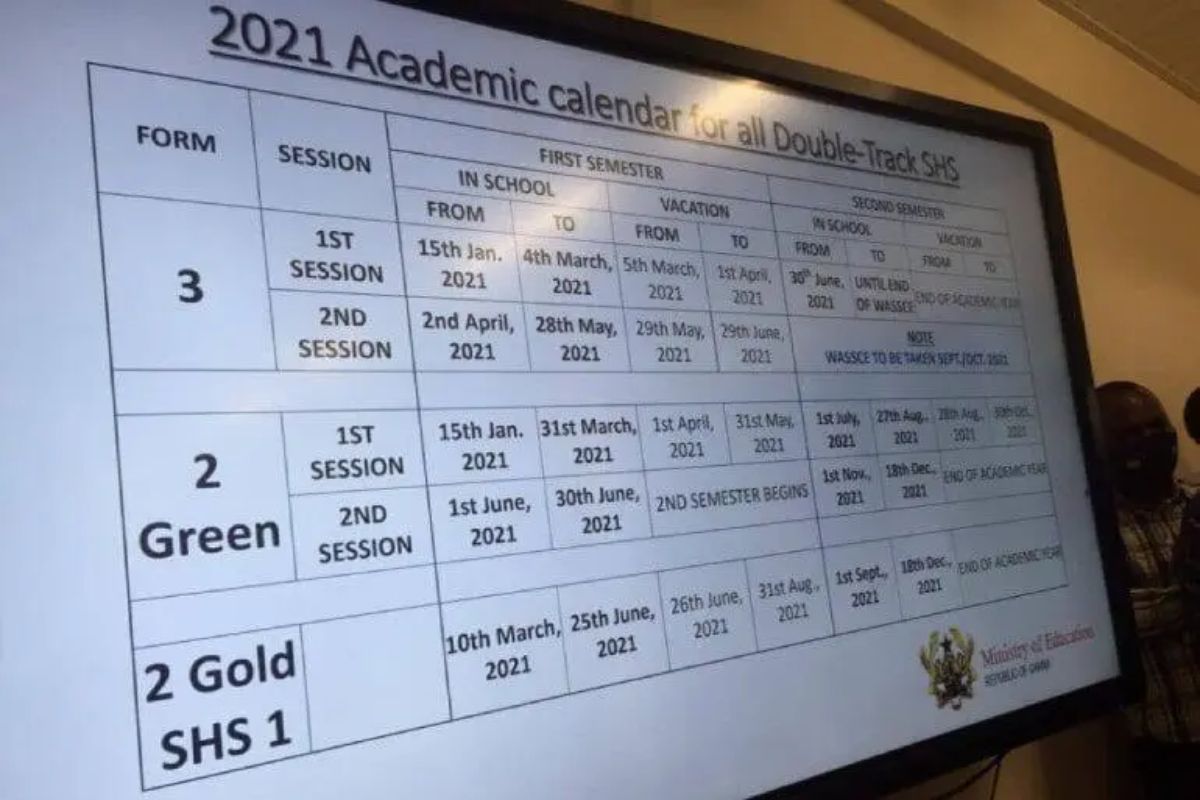

How to Check Ghana Civil Service Recruitment Application Status  GES 2024-2025 Academic Calendar for Public Schools

GES 2024-2025 Academic Calendar for Public Schools  GES to recruit university graduates and diploma holders-GES Director General

GES to recruit university graduates and diploma holders-GES Director General  Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise

Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise  GES is expected to announce reopening dates for public schools today

GES is expected to announce reopening dates for public schools today