SSNIT hunting private schools for Covid-19 period contributions

SSNIT contributions are statutory payments to be made by businesses by the 14th day of each month for the previous month’s deductions. COVID-19 hit us all in March and private businesses and schools were the hardest hit.

Schools that were scared of the potential actions of SSNIT laid-off workers. SSNIT would sue defaulters without any attempts to find out how the businesses or schools are doing.

The moment they visit your school or business, the only thing on their minds is using the courts to deal with you. SSNIT may often not hesitate to sue clients in court for contributions piling up or unpaid SSNIT contributions. Schools scared of the associated penalties laid-off workers to be safe. This was the only way to avoid the stress that comes with the SSNIT summons.

Interviews of school owners show that SSNIT is ready to sue schools and other private businesses for failing to pay SSNIT contributions accumulated during the COVID-19.

The Social Security and National Insurance Trust (SSNIT) has started hunting private schools and other private businesses in the country for SSNIT contributions of workers for the periods March to November 2020. Others who defaulted earlier before COVID-19 have not been spared either.

Private schools have not been in operation since March 2020 and may not be in a position to pay workers. However, SSNIT is adding more trouble to the already sad experience of Private schools and businesses that were hard hit by the COVID-19 with no government support.

SSNIT must begin to question its own officers mapped to the various areas to ensure businesses comply with the act regulating SSNIT data validation and payment.

The staff of the SSNIT compliance unit are required to know clients, visit them regularly to check their compliance status, provide them with guidance to ensure these private schools, and businesses do what is expected of them. In many instances, SSNIT officials never visit.

However, after failing to do their work, which includes monitoring and guiding, they are quick to take their clients to the court. The time wasted the late notices from SSNIT requesting clients to be present at court and other happenings suggest inadequate planning and coordination.

Penalties calculated and charged against clients are difficult to comprehend. There seems to be no clear formulae used to derive it. We stand to be corrected on this.

The SSNIT must also build a good customer relationship culture that ensures the customer (private schools and businesses) are frequently visited, updated, and informed of their status. Workshops for such stakeholders on the implications of non-compliances and a friendly approach to ensuring they comply can go a long way to help retrieve unpaid deductions.

ALSO READ: How your SSNIT retirement (pension) benefit is calculated

Suggestions To SSNIT To Help Us All with SSNIT contributions

1. SSNIT must come out with policies on what private schools and businesses must do in case they are financially stressed and cannot pay SSNIT contribution deducted.

2. It would be prudent that the leadership of SSNIT and its legal department take a second look at the practice of drugging businesses to the Saturday commercial courts at every given opportunity. This will give the SSNIT prosecutors some briefing space to perform other equally important duties.

3. It will be appreciated if SSNIT could reduce the rate at which their ineffective staff at the compliance unit rush to the court to cover up for their inefficiencies in discharging their duties.

These policies and guidelines must be made public so that stakeholders will be informed.

4. SSNIT, instead of filing countless cases against defaulters, must rather invite such institutions to their office to discuss the issue, come out with payment plans and make follow-ups through compliance officers of the institution to recover the delayed and unpaid contributions.

The reality is that Schools and businesses sometimes deduct SSNIT contributions, but the financial resources for paying do not exist. They do the paperwork, hoping to raise the needed funds to settle them.

5. The decision to use the courts to recover COVID-19 period defaulted SSNIT payments does not seem to be the best but could be the last resort.

6. Using the same approach for already existing arrears before the COVID-19 at this time does not also help any business. Businesses are struggling to recover from COVID-19. One would have thought SSNIT would use a more diplomatic, proactive, and firm approach than the old methods.

7. It is suggested that SSNIT quashes penalties accumulated from March to December 2020 and come out with a communique to stakeholders to explain steps it intends to take to retrieve contributions.

8. Some level of a human face in this COVID-19 ravaged business environment would give SSNIT a better outlook than the old fashion tangent it has decided to take.

9. The government of Ghana must assist businesses and help the SSNIT change the approach it has hatched to retrieve contributions just after COVID-19. We are not in normal times, SSNIT must innovate novel ideas and strategies for collecting delayed contributions.

10. Mobile SSNIT contributions collection systems that offer the institution the chance to collect payments from companies at their offices may help. Permitting businesses to pay their contributions via a Momo shortcode can also help. The use of the court should be the last resort in dealing with clients who default.

11. Officers at the compliance unit mapped to businesses and areas should also adopt good customer service practices. Leaving customers (businesses) without reaching out to them can make them relax in honoring their statutory obligations.

SSNIT, deal with the inefficiencies and unproductive staff in your compliance unit who do not visit your clients and you are likely to start dealing with problems created by the unproductive staff.

Source: GhanaEducation.Org

Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise

Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise  Teachers Advised Against Using Their Affordability to Secure Loans for Others

Teachers Advised Against Using Their Affordability to Secure Loans for Others  Dear newly qualified teacher, let me tell you a long story about salary cut

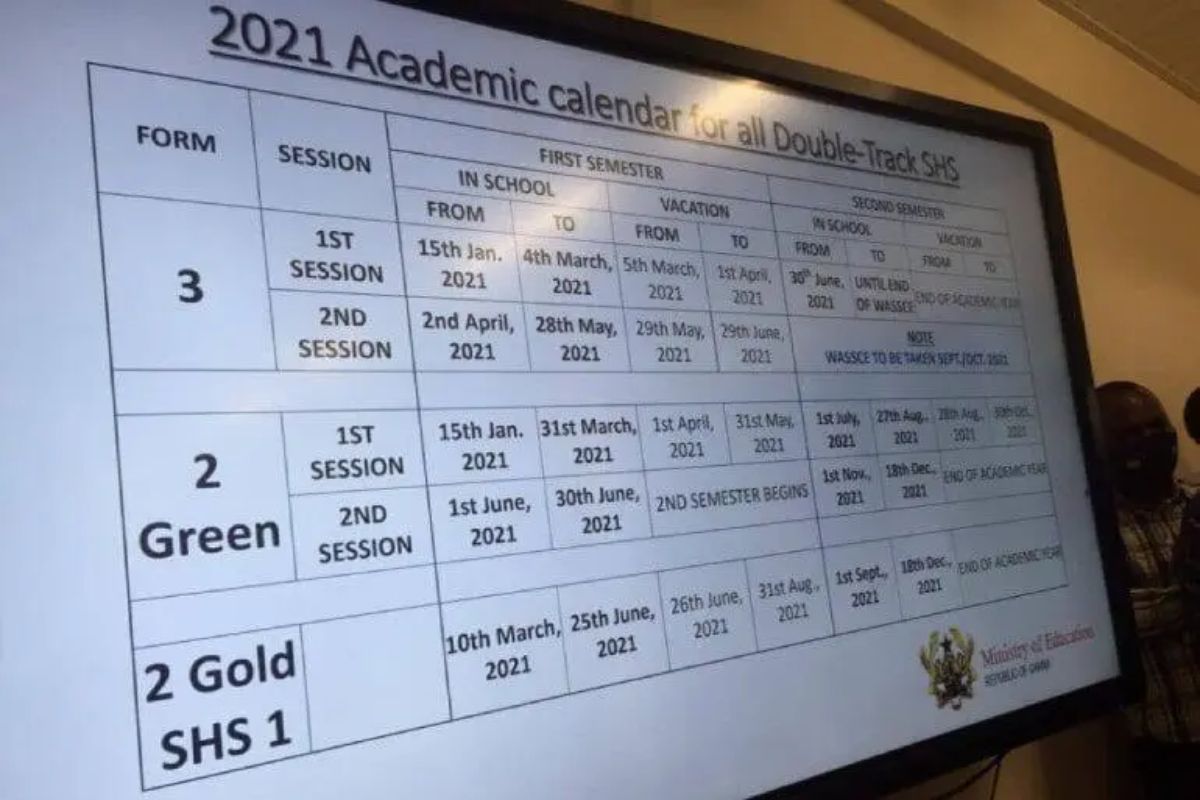

Dear newly qualified teacher, let me tell you a long story about salary cut  GES 2024-2025 Academic Calendar for Public Schools

GES 2024-2025 Academic Calendar for Public Schools  GES to recruit university graduates and diploma holders-GES Director General

GES to recruit university graduates and diploma holders-GES Director General  GES is expected to announce reopening dates for public schools today

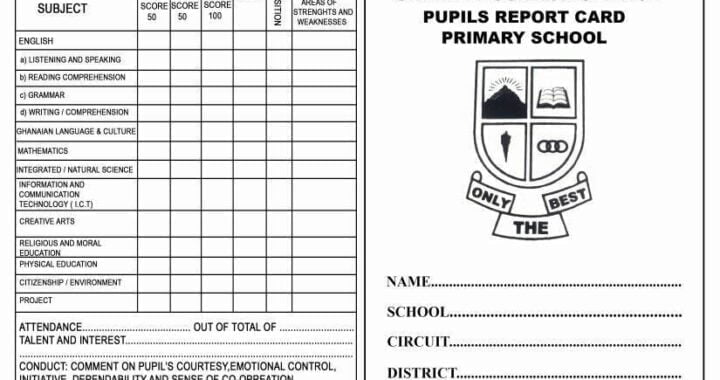

GES is expected to announce reopening dates for public schools today  2024-2025 Report Card Grading, Student Attitudes, Interests and Conduct Samples for Teachers

2024-2025 Report Card Grading, Student Attitudes, Interests and Conduct Samples for Teachers