Broker Insight: Basics and Guide to Choose the Best OANDA Platform

Guide to Choose the Best OANDA Platform and Basics to learn.

OANDA offers 3 types of trading platforms: Metatrader 4, Metatrader 5, and fxTrade. In comparison of all OANDA platforms, fxTrade remains superior.

OANDA has offered Internet-based forex trading and currency information services to retail customers and financial institutions since its establishment in 1996. It has grown from a small tech firm handling exchange rate data into a cutting-edge financial technology giant thanks to the company’s top-notch, reliable services. Most notably, the company’s award-winning proprietary trading platform, fxTrade.

OANDA currently provides three types of trading platforms, including Metatrader 4, Metatrader 5, and fxTrade. Why did fxTrade become the best OANDA platform for Basics to learn? Is it suitable for you too?

Let’s compare the three of them and choose the best OANDA platform for Basics to learn according to your trading style.

Metatrader 4 (MT4)

Since MetaQuotes Software was first made available in 2005, Metatrader 4 has been the most widely used trading platform for forex and CFD traders worldwide. What makes MetaTrader 4 such a hit? There are lots of reasons.

At one time, it was the only trading platform available for onboarding multiple brokers. On the other hand, they have created an industry standard through a wide range of tools that never go out of style, even after other (and potentially more advanced) third-party trading terminals appear.

All trading platforms, at the very least, must be able to provide live price feeds and on-the-spot technical analysis tools in order to help traders make decisions and open their own trades. But Metatrader 4 goes several steps further.

Metatrader 4 users can customize their own indicators, scripts, and trading robots (called Expert Advisors or EAs) with MQL4 programming language, then test their strategies on the same platform. They can also trade the stuff they have created to other traders in the community or even give them away for free.

Also, OANDA MT4 contains a ton of features, is comparatively simple to use, customizable, safe, and consumes relatively little of your computer’s resources. This kind of environment is particularly attractive for scalpers and beginners, although other types of traders will probably need more advanced features that are not available here.

Metatrader 5 (MT5)

As the name suggests, Metatrader 5 is the younger sibling of Metatrader 4. It should be noted, however, that Metatrader 5 is a completely new trading platform introduced in 2009 and not a mere upgrade from Metatrader 4.

Metatrader 5 offers more technical indicators, more types of orders, more timeframes, and more of everything else. Metatrader 5 also has an integrated economic calendar, depth of market (DoM), community chat, and a multi-threaded strategy tester that is not available on Metatrader 4. Most importantly, Metatrader 5 uses the MQL5 programming language, which is said to have execution speeds 20 times faster than MQL4.

OANDA MT5 carries all of these features. As such, traders tend to choose MT5 if they seek to develop a better trading career with the help of more advanced tools. You can trade regularly while improving your results with DoM and a variety of other features. You can also gain additional income from providing signals to others in the community.

fxTrade

Most people think that MetaTrader 4 is the oldest trading platform for online retail traders. But the fact is, OANDA platform – the fxTrade– was introduced earlier for PCs. OANDA even developed an API for automated trading technology on the fxTrade platform back in 2003.

The weakness of fxTrade, which makes it less popular than Metatrader, is its limited accessibility. OANDA is the only broker offering fxTrade. This was why their automated trading introduction failed to take off.

fxTrade is currently available as a mobile app that works flawlessly on both iOS and Android. It has a rich and simple interface, which is very easy to use even for those who do not have prior trading experience.

Watch the video : https://youtu.be/oJcLpj1aTb4?si=qCAUR5rtNwJ009Mr

fxTrade app has at least three exclusive features that are not available on other trading terminals:

- Fully customizable interface: You can set up and save your own unique default parameters, such as units traded, risk and profitability criteria for pending orders, and preferred financial instruments.

- Advanced charting from TradingView: You can access 9 types of charts with high customizability and lots of popular default indicators.

- All-in-one account management with one key login: You can log in to fxTrade with your OANDA credentials to access a dashboard with all of your accounts in one place. You can fund your account, withdraw your profits, monitor your results, and more directly on the app. You no longer have to close your trading platform and switch to the OANDA website for basic account management.

In short, fxTrade focuses on being a responsive mobile trading app streamlined for reliable and swift performance with industry-leading technologies. Both beginners and experienced individuals who seek to trade actively will favour this app.

How to Choose the Best OANDA Platform

First, recognize your own trading style. Do you want to trade manually by yourself or with the help of robots? In the first scenario, all OANDA platforms may be suitable for you. But if you are looking forward to trading using EAs, then you can choose Metatrader 4 or Metatrader 5.

Second, make sure you want to trade more frequently with the convenience of a PC or mobile. MT4 and MT5 work better on PC, but their mobile apps contain far fewer features and are less customizable. fxTrade is the best choice to trade on the go, as seen from its superior features and the fact that it received the Highest Mobile App Satisfaction & Third-Party Integrations award from Investment Trends US FX Report 2020.

Learn the basics of technical analysis

Get to know the basics of technical analysis in trading the markets and use them while constructing your own trading strategy.

What is technical analysis in trading?

Technical analysis for trading studies the price of an asset such as a forex pair using historical price charts and market statistics. It is rooted in the notion that if you can identify previous market patterns, you can form a fairly accurate prediction of future price action. One way of looking at technical analysis is to see it as the study of change in supply and demand as reflected in the market price movements of an asset or security.

Technical analysis can be used on any security you are looking at, including forex and cryptocurrencies, i.e., forex technical analysis or crypto technical analysis, etc.

Technical analysis versus fundamental analysis

When traders talk about technical analysis, they are referring to the study of price and volume as they see it on a chart. Unlike traders who ‘trade the fundamentals’ such as the news, traders who ‘trade the technicals’ prefer to study price patterns over time periods ranging from a few seconds to a month. This is usually done using a variety of tools, such as indicators, to understand which way price is moving in any given market.

Some traders use only technical analysis, while others prefer to rely on fundamental analysis when planning their trades. Sometimes these two trading approaches can be combined to create one robust trading strategy.

For example, a combination of technical and fundamental analysis could be used to better understand the correlation between oil and currency prices. This could help traders better understand the markets when taking a position on oil prices. For example, countries that produce and export oil in high volumes are dependent on high prices for oil. For them, a sharp drop in the price of oil would typically impact the value of the country’s currency.

Canada is a significant producer of oil and other energy products. In April of 2020, the Canadian dollar tumbled significantly against the US dollar, as the oil markets fell dramatically. Traders aware of the connection between oil and USD/CAD could have taken advantage of the Canadian Dollar’s recovery in the weeks following oil’s recovery by going short this pair until they saw a break in the trend.

Another example of being cautious and taking fundamental aspects into consideration, supply and demand in particular, was when the SARS-Cov-2 pandemic hit. The fear of coronavirus spreading and lockdowns being put in place around the world caused oil demand to drop sharply. U.S. warehouses were full of oil, there was nowhere to store it, and nobody wanted to buy it. The date of the May West Texas Intermediate Crude Oil contracts expiry was approaching, causing the price to be quoted negative for the first time in history, dropping from $18 a barrel to around -$37 a barrel.

Taking your first step in technical analysis

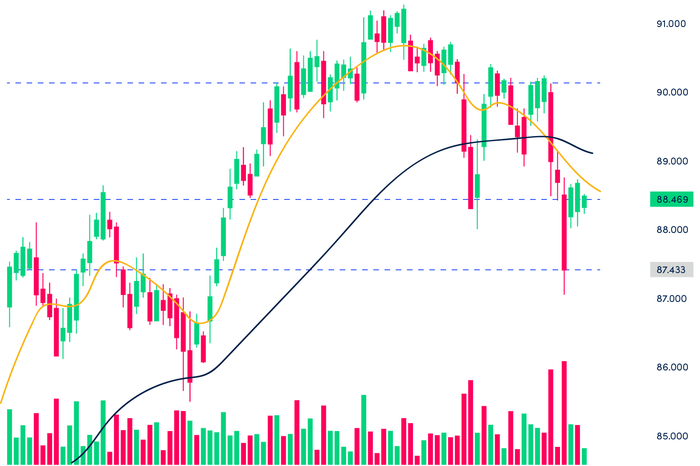

The first steps in technical analysis start with the chart to see what price is doing, as seen across the higher timeframes.

- Is there a trend (up or down) or is price stuck in a range?

- Where are the strongest areas of support and resistance?

As a technical analyst, even before you plan a trade you could first mark out the price zones where a price has found support and resistance repeatedly over time. The more often a price bounces off a support line, the stronger that area of support becomes. The same is true of an area of resistance. Even if you only think to trade the lower timeframes, it is good practice to be aware of these zones dating back months and even years. This is because history and, in this case price history, has a way of repeating itself.

Tools used by technical analysts

In general, technical analysts will also want to study a chart using their favorite tools, such as moving averages, volume and momentum indicators, and oscillators. All these tools are designed to give you a better idea of where and how fast a price is moving and help you take ‘high probability’ trades.

Finding good entry and exit points for a trade

Having marked out support and resistance areas on your chart with, say, the rectangle tool, (which you can find in your drawing tools on the chart), your next step could be to look for an opportune area where you can enter a trade. Some trade strategies may look to buy the dips and sell the tops, but the question is, which dips and which tops?

Broadly speaking, if you buy at the first bottom you see or sell as a price falls from the top, you risk being stopped out if price forms double bottoms (the second bottom often being lower than the first) and double tops, with the second top being higher than the one you wanted to trade. This is why experienced traders look for confirmation before placing an order.

Price often moves in zig zags – for every move up, there may be a move in the opposite direction, sometimes by as little as 25%, others by a full 100% or more. Let’s say you’ve identified a potential price reversal to the upside and you plan to open a buy order in the hope of getting a long run up (in the opposite direction). You’ve learned that traders ‘buy the dip’, so here’s your dip.

However, the experienced trader has learned to wait and see if an upward trend can properly form and then make a play. This is because many reversals fail. In the case of a single bottom, price can climb and then drop down the same day, often falling further than the previous major low, to form a double bottom, before resuming the climb up. The same is true of tops, especially at the end of a strong trend up: a top may form, break to the downside, then reverse sharply up, knocking out the stop losses of inexperienced traders before resuming its path down.

Develop your technical skills with the traders tools section of our website, which offers information about the different kinds of tools available on our trading platforms.

Key takeaways

- Traders use technical analysis to evaluate investments and identify trading opportunities

- Technical analysis analyzes statistical trends gathered from trading activity, such as price movement and volume

- Technical analysts use price data from different timeframes of an asset to construct high probability trades

- Key support and resistance zones are mapped on a chart to better identify good entry and exit points

- Technical analysis tools include moving averages, indicators, oscillators and drawing tools such as trend lines, triangles and pitchforks

- Many traders use fundamental analysis together with technical analysis to plan their trades, especially longer term trades

Whether you are a technical or fundamental trader, you can take advantage of our trading education. Our free webinars, workshops and how-to videos can help you learn the basics of leverage trading for free. With a live or demo account, you can start to implement some of the trading strategies that we feature in our learn section.

Past performance is not indicative of future results. This article and its contents are for

Forex trading is high risk. Losses may exceed deposits.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Send Stories | Social Media | Disclaimer

Send Stories and Articles for publication to [email protected]

We Are Active On Social Media

WhatsApp Channel: JOIN HERE

2024 BECE and WASSCE Channel - JOIN HERE

Facebook: JOIN HERE

Telegram: JOIN HERE

Twitter: FOLLOW US HERE

Instagram: FOLLOW US HERE

Disclaimer:

The information contained in this post on Ghana Education News is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Odomase sub chief donates US$2,000 worth computers to alma mater

Odomase sub chief donates US$2,000 worth computers to alma mater  Otumfuo Osei Tutu II Foundation collaborates with Newmont Ghana to build Artificial Intelligence Center at Kona

Otumfuo Osei Tutu II Foundation collaborates with Newmont Ghana to build Artificial Intelligence Center at Kona  Esther Cobbah elected President of Institute of Public Relations, Ghana

Esther Cobbah elected President of Institute of Public Relations, Ghana  GES grants SHS students break for voter registration

GES grants SHS students break for voter registration