Egypt Closes the Largest Investment Ever with UAE

A significant step forward in Cairo’s attempts to resolve its worst foreign exchange crisis in decades was the United Arab Emirates’ (UAE) commitment to spend $35 billion in Egypt.

The plans call for the development of Ras El-Hekma, a prestigious area on the Mediterranean coast of North Africa. Egypt’s Prime Minister, Mostafa Madbouly, called this project the largest in his nation’s history.

The Abu Dhabi wealth fund, ADQ, said that it will pay $24 billion for the development rights to Ras El-Hekma and spend $11 billion, which will come from UAE funds held in Egypt’s central bank, in more real estate and other high-profile projects in the nation.

Speaking on Friday, Madbouly stated that the agreement deal will provide Egypt with an additional $24 billion in liquidity. According to him, the plans would also be financed by the UAE converting its $11 billion in deposits held with the Egyptian central bank.

ALSO READ: US death toll rises to 22; lawmaker says Egypt warned Israel before attack: Live updates

At the gathering in the new administrative capital east of Cairo, Madbouly stated that Egypt is now “very, very few steps” away from striking a new agreement with the International Monetary Fund following the accord.

Egypt’s foreign bonds saw a sharp increase on Friday, making them the best-performing government debt in emerging markets. The dollar note issued by the government, which is due in 2051, increased by a record 5 cents.

“This agreement represents a message of confidence” from the UAE, according to Madbouly, who also described it as the start of Egypt’s economic correction.

With the finance in place, Egypt might proceed with its much-awaited fourth currency depreciation since early 2022. The authorities were probably waiting for a significant inflow of foreign cash that would enable them to handle an adjustment, even though the IMF has been pushing for this action for months.

Egypt, according to Madbouly, anticipates upfront payments from the UAE in two installments. This will consist of $20 billion in two months and $15 billion in a week, with a third coming from the UAE’s deposits.

ALSO READ: Move To Dubai By 2024 | UAE Top Recruiters & Job Offers | Apply Here

Six billion from the UAE’s residual deposits and $14 billion in new funding will make up the second tranche.

According to Madbouly, the money will assist in balancing the official exchange rate of the local currency with its value on the underground market. The pound is trading at roughly 30.9 per dollar at domestic banks, which is slightly higher than its street rate of about 60.

The pound’s three-month contract gained over 8% to around 49 on Friday in the non-deliverable futures market, indicating expectations of a less significant devaluation.

‘The Last Opportunity’

Egyptian billionaire Naguib Sawiris, who recently proposed that authorities should align the two rates of the pound, described the agreement as “extraordinary support and unprecedented generosity” from the UAE.

Sawiris expressed optimism that “the Egyptian leadership realises that this is a last opportunity to change the current course” and urged the country to “listen to its people and open the closed doors of freedom” in a post on social media platform X.

Egypt will receive a third of the profits from the Ras El-Hekma project, and the Gulf state has agreed to a joint venture that aims to construct an international airport there.

There might be more money coming to Egypt. Its current $3 billion rescue package, of which very little has been distributed, could be increased to more than $10 billion through a proposed deal with the IMF, which would also bring in additional partners.

The agreement will strengthen Egypt’s relations with the United Arab Emirates, whose capital is Abu Dhabi. President Abdel-Fattah El-Sisi has the support of the energy-rich Gulf nation, which has pledged investments and other forms of support for the Egyptian economy, which has been stuck in a crisis for nearly two years.

Goldman Sachs Group Inc. economist Farouk Soussa stated, “The magnitude of the investment is far greater than what we had been expecting, and the timing is far sooner.” In the upcoming days and weeks, it “offers Egypt the chance to restore two-way liquidity in the FX market.”

The UAE’s most recent round of funding started in 2022 with a $5 billion deposit in Egypt’s central bank and payments of roughly $2 billion by ADQ for transactions that included the acquisition of roughly 18% of Commercial International Bank, the largest listed lender in Africa.

ADQ invested $800 million in minority positions in the petrochemical manufacturer Egyptian Linear Alkyl Benzene, the oil company Egyptian Drilling Co., and the Egyptian Ethylene and Derivatives Co.

A local-currency swap agreement worth approximately $1.4 billion was agreed by Egypt and the Gulf nation in September, and a UAE business paid $625 million for a 30% interest in Egypt’s largest tobacco industry.

Work on Ras El-Hekma, whose enormous expanse spans over 170 million square metres and is almost three times the size of Manhattan, is expected to begin in early 2025, according to ADQ.

MORE STORIES: Bawumia leads gov’t delegation to commiserate with UAE Leader

“This deal is revolutionary because of its size and timeliness, which significantly alters Egypt’s future prospects,” stated Monica Malik, chief economist at Abu Dhabi Commercial Bank PJSC. “The inflows will significantly help Egypt meet its external funding needs and reduce its foreign exchange backlog.”

Civil Service Announces 2024 Online Examination Details for Graduate Applicants

Civil Service Announces 2024 Online Examination Details for Graduate Applicants  BREAKING: President Biden Announces Decision Not to Seek Reelection

BREAKING: President Biden Announces Decision Not to Seek Reelection  Real Reason Behind the Appointment of Yohunu as Deputy IGP

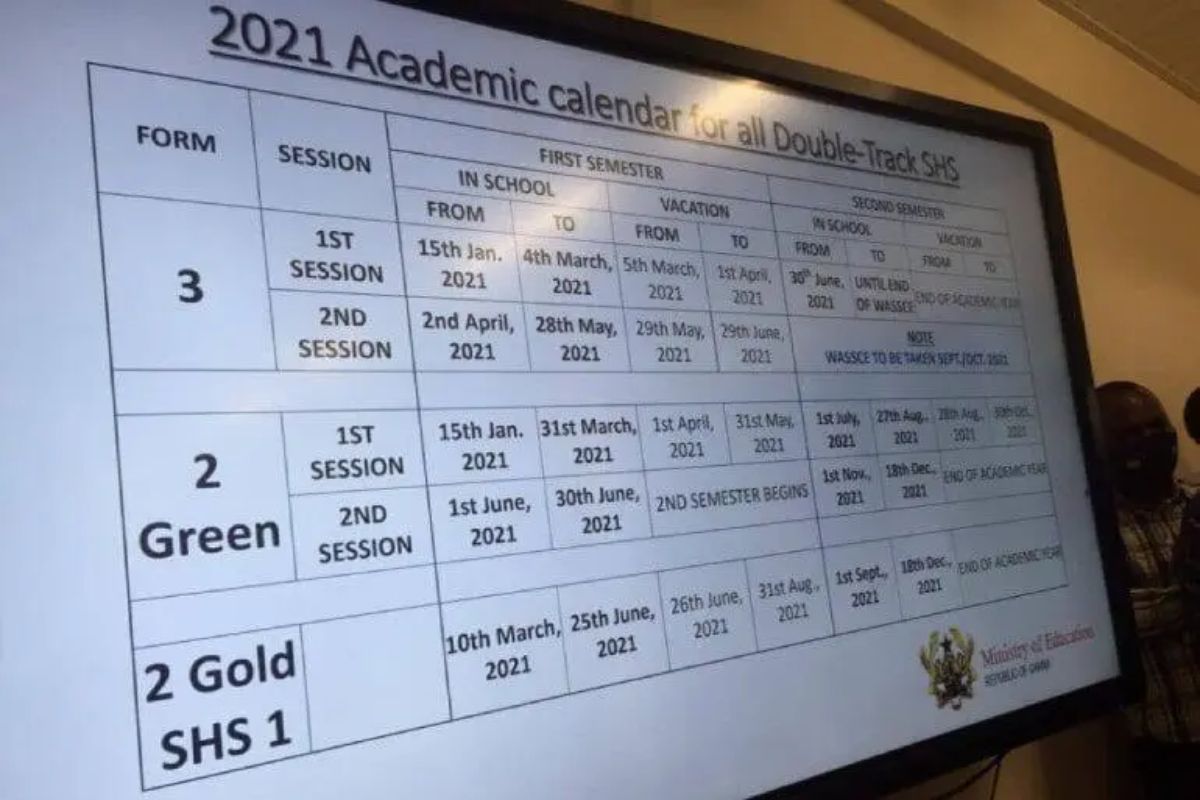

Real Reason Behind the Appointment of Yohunu as Deputy IGP  GES 2024-2025 Academic Calendar for Public Schools

GES 2024-2025 Academic Calendar for Public Schools  GES to recruit university graduates and diploma holders-GES Director General

GES to recruit university graduates and diploma holders-GES Director General  Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise

Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise  GES is expected to announce reopening dates for public schools today

GES is expected to announce reopening dates for public schools today