Ghana Central Bank Plans Emergency Meeting After Currency Slump – Bloomberg

- Ghana Central Bank Plans Emergency Meeting After Currency Slump

-

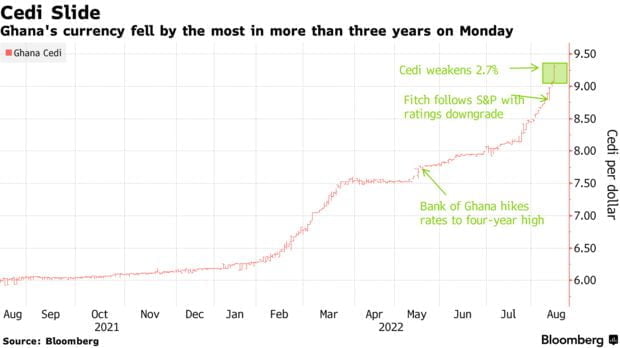

Nation’s currency plunged 2.7% to a record low on Monday

-

Fitch, S&P cut Ghana’s rating further into junk this month

The Bank of Ghana’s monetary policy committee will hold an emergency meeting on Wednesday as the nation’s currency continues to weaken and inflation accelerates at the fastest pace in almost two decades.

The cedi fell 1.6% on Tuesday, extending this year’s slump to 35% and making it the world’s worst performer among the 150 currencies tracked by Bloomberg, after bankrupt Sri Lanka’s rupee. The annual inflation rate in July climbed more than expected to 31.7% from 29.8% a month prior, the statistics office said Aug. 10.

The MPC will meet to “review recent developments in the economy,” according to a statement emailed from the capital, Accra. That’s after it left borrowing costs unchanged at 19% last month on expectations that inflation may be leveling off and to allow a cumulative 550 basis points of rate hikes since November to filter through the economy.

The central bank is the second in sub-Saharan Africa after the Bank of Uganda to hold an emergency meeting since Russia’s war with Ukraine erupted in February.

The meeting comes after regulators announced Monday that water and electricity tariffs will rise 22% and 27% respectively from next month. Those increases will add to the deteriorating inflation outlook in Ghana, said Absa Group Ltd. analyst Ridle Markus.

“Our projections point to a peak inflation print of between 35-36% year-on-year by the fourth quarter, with significant upside risk, unless there is a sharp pullback in the currency and food price pressures turn around,” Markus said. Absa expects the Bank of Ghana will raise rates by 200 basis points on Wednesday.

The MPC may raise rates to reinforce its anti-inflation credentials, said Razia Khan, head of research for Africa and the Middle East at Standard Chartered Bank in London. In a high-inflation environment, rollover risk is exacerbated, complicating the financing of the budget deficit, she said.

Ghana Central Bank Plans Emergency Meeting After Currency Slump – Bloomberg Image On Current State of Ghana Cedi

Authorities “are having to issue much more short-dated securities, simply because in an inflation environment, no one wants to lock into anything with a much more longer dated tenor,” she said. “This increases the rollover risk that the authorities face, even though rates have generally stayed below the current rate of inflation.”

Buffeted by its plunging currency, surging prices and declining foreign-exchange reserves, West Africa’s second-largest economy earlier this year approached the International Monetary Fund for a loan of as much as $3 billion. Fitch Ratings last week followed S&P Global Ratings in cutting Ghana’s sovereign credit rating further into junk.

READ:The current Ghana card and a possible Ghana visa lottery

“The downward spiral for Ghana does not seem to be poised for an about-turn,” Pieter du Preez, an economist at Oxford Economics, said in a note to clients Monday. “The latest credit rating downgrades underline the importance for the Ghanaian government to move forward with both monetary and fiscal reforms.”

The yield on Ghana’s eurobonds maturing in 2032 climbed 16 basis points to 20.81% by 10:42 a.m. in Accra.

Source: Bloomberg.com

Send Stories | Social Media | Disclaimer

Send Stories and Articles for publication to [email protected]

We Are Active On Social Media

WhatsApp Channel: JOIN HERE

2024 BECE and WASSCE Channel - JOIN HERE

Facebook: JOIN HERE

Telegram: JOIN HERE

Twitter: FOLLOW US HERE

Instagram: FOLLOW US HERE

Disclaimer:

The information contained in this post on Ghana Education News is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Asogli State rejects renaming Ho Technical University after Ephriam Amu

Asogli State rejects renaming Ho Technical University after Ephriam Amu  KNUST Pro Vice-Chancellor makes donation of $10,000 To GReF

KNUST Pro Vice-Chancellor makes donation of $10,000 To GReF  Lydia Alhassan provides free transport for UG level 100 students

Lydia Alhassan provides free transport for UG level 100 students  How to buy UG Admission Voucher with Momo/Shortcode

How to buy UG Admission Voucher with Momo/Shortcode  The Poll Tax Ordinance of 1852

The Poll Tax Ordinance of 1852  Top 5 Universities in the Netherlands for Masters Studies

Top 5 Universities in the Netherlands for Masters Studies