Ghana Commercial Bank Sends Another Urgent Message To All Customers

The Ghana Commercial Bank has advised the public to be wary of persons who are operating a Ponzi scheme in the name of the Bank to defraud unsuspecting clients.

In a statement, Ghana Commercial Bank said that it will contact its customers on only one number which us 0302634922.

It is believed that the management of the bank has already reported the activities of these scammers to the relevant law enforcement agencies who are currently investigating the case to ensure that these criminal activities are stopped immediately

“Beware of people calling to ask for your Password, PIN or Card Number in the name of GCB. GCB staff will never request for such confidential information. Note that GCB will only contact you with this number: 0302634922”

Crooks use clever schemes to defraud millions of people every year. They often combine sophisticated technology with age-old tricks to get people to send money or give out personal information. They add new twists to old schemes and pressure people to make important decisions on the spot. One thing that never changes: they follow the headlines and the money.

Stay a step ahead with the latest info and practical tips from the nation’s consumer protection agency. Check back here to get tips and tricks to identify SPAM mails and correspondence.

Below are some ways you can fellow to keep your account safe in Ghana.

Protect your identity.

Being able to prove your identity is an integral part of modern banking. Unfortunately, there is a growing range of crimes that involve the use of either stolen or fictitious identity.These pages explain what you can do to help prevent someone from misappropriating your banking details and using it for criminal activity, and also provides advice on what kind of help you can ask for if you think you may be a victim of identity theft.

Identity theft and fraud prevention

Identity theft is the misuse of another persona’s identity without their knowledge or consent. Identity fraud is the use of a stolen identity in criminal activity to obtain goods, services or finance by deception. A fraudster might obtain access to your personal information or steal your identification documents, such as identity card, passport, license, debit or credit cards, in order to commit identity fraud.

Dealing with the bank

Remember that when you deal with GCB, we will always ask for proof of identification when opening accounts and for all types of transactions. This is for your own protection, and to ensure it is you we are dealing with.

Always be careful

Do not divulge your personal banking details to anyone calling from a financial institution that you are not familiar with. They could be trying to get your identity details or existing finance information (such as account or card numbers) to commit a fraud. You should always check the identity of these people by offering to call them back to confirm that they are really from the organisation they claim to represent.

READ ALSO: Ghana Meteorological Agency Breaks Silence On Accra Earth Tremor

Documentation

Be cautious with anything that gives away any of your personal details such as bank and card statements, cheque book stubs, or anything that can be used as identification. Shred or destroy any documents that you no longer require, or store them in a safe place.

Personal information

Don’t be tricked into giving away any details that could help anyone gain access to your bank accounts, and never respond to emails or telephone calls asking for personal or financial information.

Act quickly

If any of your IDs, cards or cheque books is lost or stolen, report this to us immediately. If you suspect theft or fraud, contact the police as well. If you are contacted about debt that you know nothing about, do investigate it – do not ignore it as a possible error. If someone has used your name to obtain goods or services, a criminal offence has been committed and you should report this to the Police immediately.

Internet banking security

How to stay safe when you use the internet on computers and mobile devices.

In our world of ever-evolving technology, internet banking is a common aspect of modern banking. Internet fraud is just as prevalent, increasingly attacking the privacy and identity of online banking users.

Stay safe online by looking out for the following forms of internet fraud:

Phishing

Phishing is used to gain personal information through fraudulent email messages that appear to come from legitimate banks. These messages appear authentic and may even use the company logo or message format. Phishing emails can be identified because they try to offer reasons for recipients to urgently divulge their personal particulars by replying to the email or logging onto a website. They may request information such as account numbers, passwords and credit card numbers or PINs.

Identity theft and fraud prevention

Identity theft is the misuse of another persona’s identity without their knowledge or consent. Identity fraud is the use of a stolen identity in criminal activity to obtain goods, services or finance by deception. A fraudster might obtain access to your personal information or steal your identification documents, such as identity card, passport, license, debit or credit cards, in order to commit identity fraud.

Replica websites

These are websites you are directed to by phishing emails. These websites are used to capture your personal details. They may contain spelling mistakes or look visually different from a real banking website, which is an indication that they are not authentic sites.

Viruses

A computer virus moves between computers just like a cold virus is passed between people. A computer virus must be attached to a programme or document in order to infiltrate other computer software. They are most commonly transferred by email.

Worms

A worm is a computer programme that can copy itself between machines. They infect other machines through computer networks and expand very quickly from a single copy. A worm usually exploits a security hole in operating systems or software.

Trojans

A Trojan is a programme that enters your computer undetected, giving unrestricted access to your data and can transmit confidential information such as card details or passwords at any time. Trojans can be sent as an email, attachments or embedded in a website. One preventative measure is to always exit your internet application instead of just closing the window.

Banking safely on the internet relies on some basic precautions:

Secure your computer

There are a number of measures you can take to secure your device. Most importantly, always ensure that you log out of internet banking properly. You can also use a personal firewall and maintain an anti-virus product.

Secure your passwords

Securing your passwords is an essential part of protecting your online identity and safety. Remember not to give you PIN or password to anyone else, including bank staff or Police. Avoid storing your password in your computer and do not use passwords that can be easily guessed. If you suspect that your internet banking password has been compromised, change it immediately.

Bank securely with your cards and at ATMs

Familiarise yourself with basic bank card safety information to stay safe when you bank.

Automated Teller Machines (ATMs) can be extremely convenient, offering round the clock access to cash as well as a wide range of banking transactions.

It’s important, however, to remember a few, simple safety points to protect against fraud.

Whatever type of bank card you have, it’s important that you keep it safe. Cards that are lost or stolen along with their PINs and passwords can be used to access accounts, which could result in a loss of funds from your account. Always take reasonable steps to safeguard your card, PINs and passwords.

If not, you may be liable for transactions that you didn’t authorise.

Don’t forget to take your card out of an ATM. Keep it safe, especially in crowded places. Don’t lend it to anyone, even a friend, as you won’t be able to control how it is used while it is not in your possession.

Check your cards receipts against your monthly statement and contact GCB if there are any discrepancies.

You are responsible for promptly advising GCB of the loss, theft or unauthorised use

of your cards, or disclosure of your PIN or password, as soon as you are aware that this has happened.

Send Stories | Social Media | Disclaimer

Send Stories and Articles for publication to [email protected]

We Are Active On Social Media

WhatsApp Channel: JOIN HERE

2024 BECE and WASSCE Channel - JOIN HERE

Facebook: JOIN HERE

Telegram: JOIN HERE

Twitter: FOLLOW US HERE

Instagram: FOLLOW US HERE

Disclaimer:

The information contained in this post on Ghana Education News is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

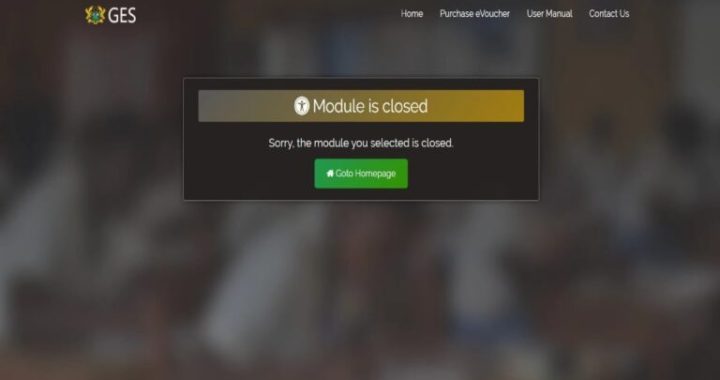

How to apply for 2024/2025 recruitment at GES recruitment portal

How to apply for 2024/2025 recruitment at GES recruitment portal  GPA raises concerns over NaCCA books assessment & approval role

GPA raises concerns over NaCCA books assessment & approval role  GES ranked 3rd in 2023/2024 Excellence Awards for MoE agencies

GES ranked 3rd in 2023/2024 Excellence Awards for MoE agencies  GES apologises for 2024/25 teachers application portal downtime

GES apologises for 2024/25 teachers application portal downtime