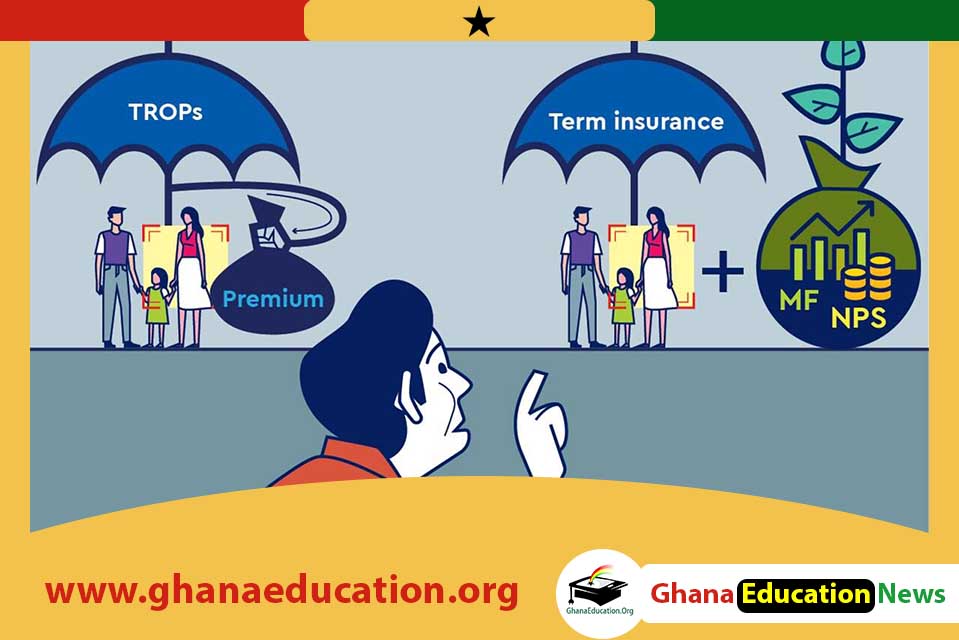

Mistake To Avoid When Buying Term Insurance And How To Fix Them

With a term insurance policy, you may provide financial stability for your family in the event of your untimely death. Beneficiaries of the policy get death benefits upon your death. It is up to the dependents to decide how and when to spend the money they receive in order to achieve their life goals.

In the realm of term insurance, many individuals tend to make mistakes. Because of these blunders, the policyholders are unable to take use of the full benefits of term insurance. Consider a few typical mistakes individuals make when buying term plans and how to avoid them in the future.

Choose a limited policy term

Idealistically, the beneficiaries of a term policy would only get death payments if they were to die. No payouts are paid if the insurance holder or the beneficiaries outlive the policy’s term. As a result, if you choose a short-term strategy, it will be unsuccessful in meeting your financial needs.

To avoid this, we advise that you choose a term plan with the longest coverage period possible. A few market-available policies offer coverage up to 99 or 100 years of age.

Mistake To Avoid When Buying Term Insurance

Opt for a lower coverage

It’s a typical error when purchasing term insurance to choose a low sum assured in an attempt at reducing the cost of the policy. When they do this, they don’t take into account the financial demands of their loved ones as well as inflation and their future financial objectives. It will be difficult for a family to satisfy its financial obligations if they choose a lower level of coverage.

It’s important to pick a term insurance sum insured that would cover your family’s financial needs in the event of your death. Their everyday costs should be covered and they should be able to achieve their future goals without having to worry about their finances.

Buying plans without comparison

Someone else who makes this error is buying a term life insurance policy without first examining alternative options. Term policy comparisons on the internet may help you better understand the many features and advantages, coverage of the plans, cost and exclusions, among other things. Anywhere in the globe, this allows you to make an educated selection when purchasing term insurance products.

How to fix: Term insurance plans may be compared using a variety of internet comparison tools. Additionally, if you wish to calculate the rates depending on the coverage you require, the term insurance calculator tool may help you do so.

Do not consider rider benefits too much

As a way to make term insurance policies a bit more flexible, insurers throughout the world provide rider advantages to their customers. These perks tend to improve the policy’s coverage. You’ll have to pay additional payments if you choose to add riders to your standard term insurance policy. As a result, many consumers choose to steer clear of term insurance with rider benefits altogether. Ask the insurer which rider benefits exist and whether you are paying for them.

How to fix: This knowledge helps consumers pick add-on insurance that might increase the breadth of their term plan by increasing its coverage. Policies such as critical sickness benefits can assist you (the policyholder) pay for future medical expenditures incurred due to critical health problems. The accidental death benefit is another rider advantage that should be considered. If you die in an accident, this benefit will pay you additional money. If you survive the term of the insurance, you can collect the premiums you paid for the term plan.

RECOMMENDED:

- Ghana’s BEST Term Insurance Company that creates jobs for policyholders.

- Why Buy Term Insurance NOT Ordinary Life Insurance.

- Why Buy Term Insurance NOT Ordinary Life Insurance

Now that you know the Mistake To Avoid When Buying Term Insurance And How To Fix Them, let us help you.

CHAT WITH US, LET US HELP YOU BUY GHANA’S BEST ERM INSURANCE POLICY THAT CREATES RESIDUAL INCOME FOR YOU AS A POLICY HOLDER. CHAT US NOW, CLICK THE BUTTON BELOW

If you do not make one of these mistakes, you will be unable to pick a term insurance plan that meets your needs and protects your loved ones financially after your death.

Civil Service Announces 2024 Online Examination Details for Graduate Applicants

Civil Service Announces 2024 Online Examination Details for Graduate Applicants  BREAKING: President Biden Announces Decision Not to Seek Reelection

BREAKING: President Biden Announces Decision Not to Seek Reelection  Real Reason Behind the Appointment of Yohunu as Deputy IGP

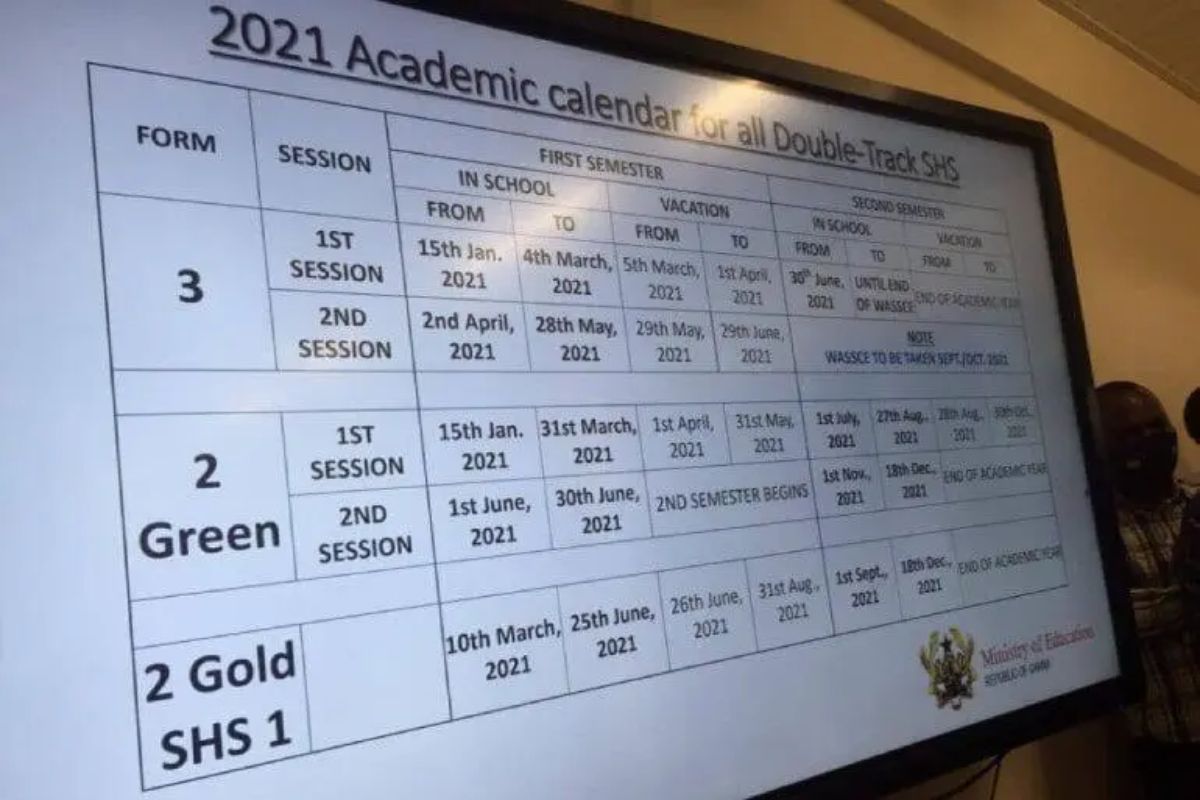

Real Reason Behind the Appointment of Yohunu as Deputy IGP  GES 2024-2025 Academic Calendar for Public Schools

GES 2024-2025 Academic Calendar for Public Schools  GES to recruit university graduates and diploma holders-GES Director General

GES to recruit university graduates and diploma holders-GES Director General  Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise

Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise  GES is expected to announce reopening dates for public schools today

GES is expected to announce reopening dates for public schools today