Why Buy Term Insurance NOT Ordinary Life Insurance

Why Buy Term Insurance NOT Ordinary Life Insurance? In this insurance-focused content, you will learn exactly why to opt for Term Insurance. When you make that choice, contact us to help you buy the best Term Insurance in Ghana which also helps you start your own side business that pays. Again, this insurance company does not complete your insurance policy until they help you undertake medical examinations in one of Ghana’s finest diagnostic centres.

Click to connect>>> INSURANCE THAT SECURES THE FUTURE to book a call from a financial adviser who will help you start this amazing journey.

This sort of policy covers you for a defined length of time, or “term” of years. As long as the policy is valid, or in effect, a death benefit will be paid out if the insured dies during the stated time period.

Term life insurance is significantly less expensive than permanent life insurance at the beginning of the policy term. Term insurance, on the other hand, does not have a financial value. To put it another way, the sole value is the death benefit provided by the insurance policy itself.

Why Buy Term Insurance: Understanding Term Insurance

You may choose from a wide range of term insurance products to suit your needs. There are several plans that give flat premiums for a set period of time, such as 10 years, twenty years, or thirty years. Also known as “level-term” plans. To offer the benefits of an insurance policy, insurance firms charge policyholders a premium, which is usually paid monthly.

A person’s health, age, and life expectancy are taken into account when the insurance company determines the premiums to be paid. Depending on the insurance chosen, a medical exam that examines the person’s health and family medical history may be necessary.

There are no surprises when it comes to payments. Insurance companies will pay the face value of the policy if the insured dies before it expires. A person would not be covered or compensated if the period ended and they died.

Although policyholders have the option to extend or renew their insurance, the new monthly price will be dependent on the policyholder’s age and health upon renewal. Consequently, the premiums for the renewed insurance might be greater than the initial term policy that was purchased while the person was younger.

Premiums might vary according to age and payment amount. People in their 20s may pay $15 per month for 30-year insurance with a $250,000 payout, while those who are in their 50s may pay less than $60 per month. Every insurer will have varying premiums based on criteria such as health, smoking history, and other considerations.

This sort of policy covers you for a defined length of time, or “term” of years.

As long as the term insurance is still active, a death benefit will be paid if the insured dies within that period.

For the length of the policy, many term insurance policies have a fixed premium rate.

Another alternative is to convert a term policy to a permanent policy, which might have a diminishing or growing benefit throughout the course of the policy’s term.

Convertible Term

It is possible to convert a term insurance policy that has a limited number of years before expiration into a whole life or permanent insurance policy with convertible term life insurance. In order to convert a term policy to permanent insurance, the policyholder does not have to submit to a medical exam, and no health problems are taken into account.

Term insurance has two features that make it attractive:

For a set period of time, the premium and survivor benefit will be guaranteed.

The insurance does not have the potential to accumulate cash. You can’t pay more to obtain more benefits. Other accounts can’t be used as a source of funds for the policy. Your account will not receive dividends or interest from the carrier.

You can use this product to cover yourself for a short period of time. Indemnifying a mortgage or a company loan is one example.

Click to connect>>> INSURANCE THAT SECURES THE FUTURE to book a call from a financial adviser who will help you start this amazing journey.

READ: Buy Life Insurance Policy that creates a job for you, examines you medically

In addition, if you exceed the guarantee period and still require coverage, the cost of term insurance generally skyrockets.

Civil Service Announces 2024 Online Examination Details for Graduate Applicants

Civil Service Announces 2024 Online Examination Details for Graduate Applicants  BREAKING: President Biden Announces Decision Not to Seek Reelection

BREAKING: President Biden Announces Decision Not to Seek Reelection  Real Reason Behind the Appointment of Yohunu as Deputy IGP

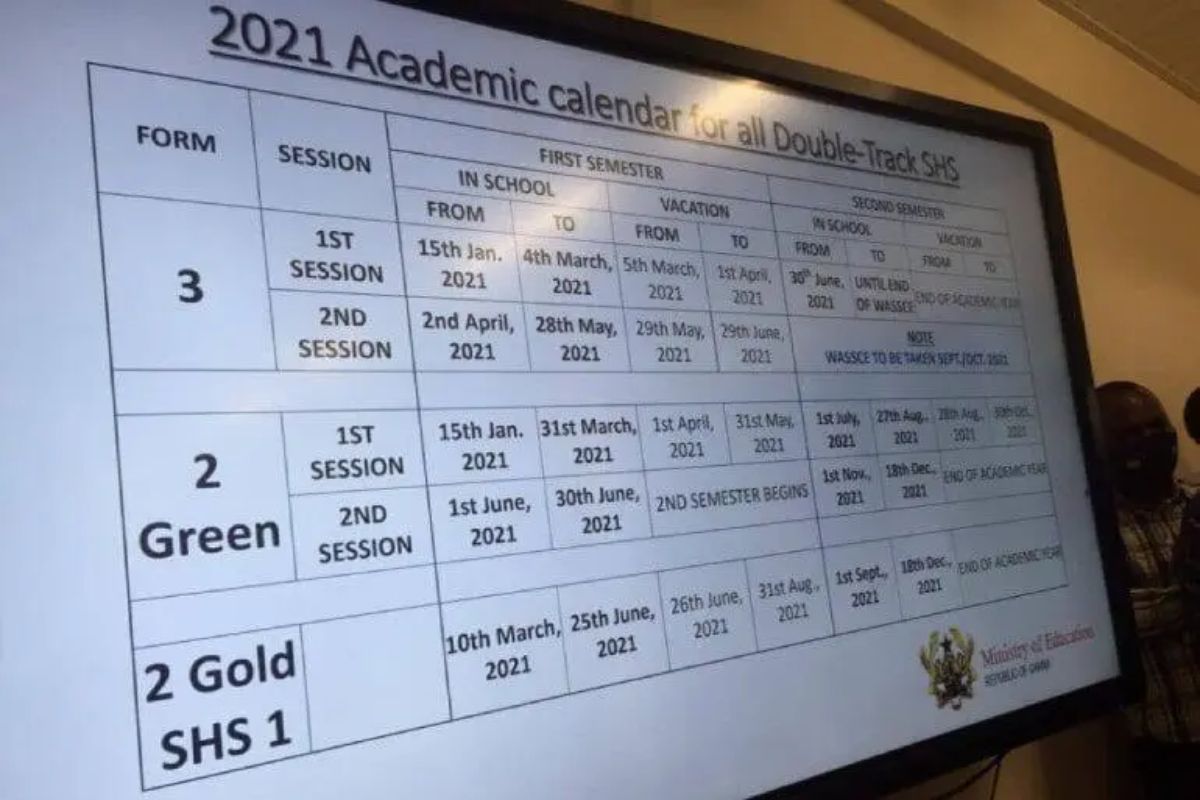

Real Reason Behind the Appointment of Yohunu as Deputy IGP  GES 2024-2025 Academic Calendar for Public Schools

GES 2024-2025 Academic Calendar for Public Schools  GES to recruit university graduates and diploma holders-GES Director General

GES to recruit university graduates and diploma holders-GES Director General  Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise

Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise  GES is expected to announce reopening dates for public schools today

GES is expected to announce reopening dates for public schools today