WASSCE 2023: Likely Financial Accounting Questions

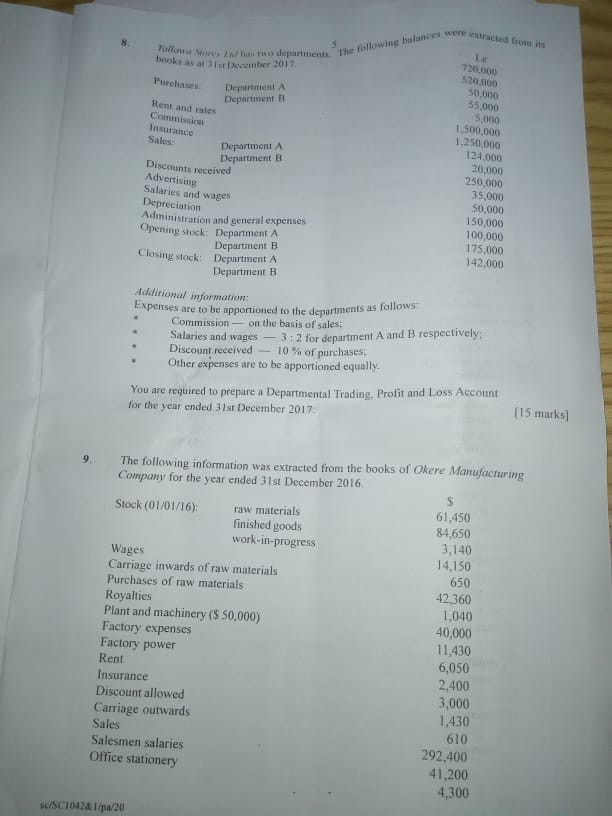

Let’s take a look at these likely Financial Accounting questions for the 2023 WASSCE. Candidates are advised to solve all the questions listed below.

1. Which method of depreciation would you recommend for the following and why?

a. Freehold Land

b. Mines

c. Mines

d. Patents

e. Plant and Machinery

2. The following are common fallacies associated with depreciation. Explain why these statements are incorrect

i. Depreciation should be provided out of profits

ii. It is not necessary to make a charge for depreciation in accounts so long as the asset is kept in good condition

iii. Provision for depreciation provides cash for the replacement of an asset

iv. Depreciation should provide for obsolescence

b. What advantage does a straight line method of depreciation have over the other methods

3. (a)What is a suspense account?

(b) Explain five errors that would not affect the agreement of the Trial balance.

(c) Mention a class of account that would always show:

(i) debit balance;

(ii) credit balance

4. (a) State two ratios which fall under the following classification of accounting ratios:

(i) profitability;

(ii) activity;

(iii)liquidity;

(iv) investment;

(v) leverage

(b) Outline:

(i) three uses of accounting ratios;

(ii) two limitations in the use of accounting ratios.

Principles Of Cost Accounting Final Projected Topics

5.(a) What is a manufacturing account?

(b) Explain the following terms:

(i) prime cost;

(ii) factory overheads;

(iii) work-in-progress;

(iv) cost of goods transferred;

(v) finished goods;

(vi) profit on manufacturing.

5. For each of the underlisted errors, identify the type of error and explain its effect on the trial balance

i. Purchase of consumables poster to the purchase account

ii. Weekly total discount allowed to debtors from the debit side of the cash book posted to the credit side of the discount allowed account

iii. An invoice amount incorrectly copied to the purchase day book

iv. Return outwards for the week posted to the personal account only

6. Explain the following terms as they are used in contract accounts:

(a) Notional profit;

(b) Retention money;

(c) Progress payments;

(d) Work certified;

(e) Work-in-progress

Send Stories | Social Media | Disclaimer

Send Stories and Articles for publication to [email protected]

We Are Active On Social Media

WhatsApp Channel: JOIN HERE

2024 BECE and WASSCE Channel - JOIN HERE

Facebook: JOIN HERE

Telegram: JOIN HERE

Twitter: FOLLOW US HERE

Instagram: FOLLOW US HERE

Disclaimer:

The information contained in this post on Ghana Education News is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

2024 WASSCE Sample and Trial Questions for Candidates

2024 WASSCE Sample and Trial Questions for Candidates  UCC Opens 2024 Postgraduate Admissions For Career-Oriented Sandwich Session

UCC Opens 2024 Postgraduate Admissions For Career-Oriented Sandwich Session  How to download and use final timetables for 2024 BECE and WASSCE to prepare

How to download and use final timetables for 2024 BECE and WASSCE to prepare  How to apply for 2024/2025 recruitment at GES recruitment portal

How to apply for 2024/2025 recruitment at GES recruitment portal  GPA raises concerns over NaCCA books assessment & approval role

GPA raises concerns over NaCCA books assessment & approval role  GES ranked 3rd in 2023/2024 Excellence Awards for MoE agencies

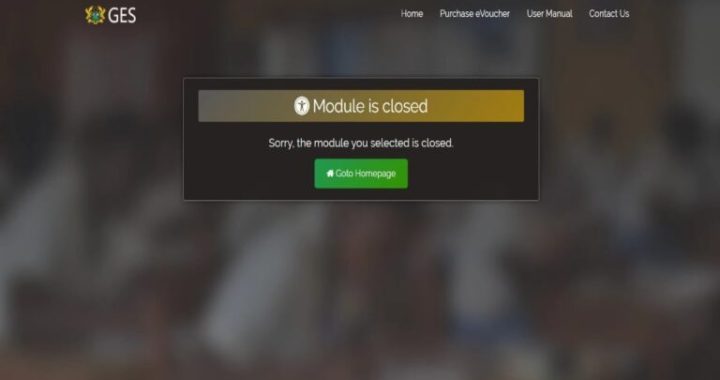

GES ranked 3rd in 2023/2024 Excellence Awards for MoE agencies  GES apologises for 2024/25 teachers application portal downtime

GES apologises for 2024/25 teachers application portal downtime