Dollar-to-Cedi Exchange Rates for November 23rd, 2023: Selling at GHS12.25

Today’s dollar-to-cedi exchange rates are out and selling at GHS 12.25 in forex bureaus. The Ghana Commercial Bank is selling at GHS 12.00 and CBG Bank at GHS 12.15, while FinTecs such as WeWire Africa and CediConvert are selling at GHS 12.32 and GHS 12.39, respectively.

As of November 23rd, 2023, the dollar-to-cedi exchange rate fluctuates across various platforms, each offering its unique buying, selling, and mid-rate.

Crypto Exchanges:

- Binance P2P: 12.20 (Buying) – 12.20 (Selling) – 12.20 (Mid-Rate)

- CediConvert: 12.04 (Buying) – 12.39 (Selling) – 12.21 (Mid-Rate)

Fintech Platforms:

- WeWire Africa: 12.08 (Buying) – 12.32 (Selling) – 12.20 (Mid-Rate)

Forex Bureaus:

- GAFORB: 12.00 (Buying) – 12.25 (Selling) – 12.12 (Mid-Rate)

- AfriSwap: 12.00 (Buying) – 12.25 (Selling) – 12.12 (Mid-Rate)

- Express: 12.00 (Buying) – 12.25 (Selling) – 12.12 (Mid-Rate)

Money Transfer Services:

- Western Union: 11.80 (Buying)

- Revolut: 11.78 (Buying)

Commercial Banks:

- GCB Bank: 11.75 (Buying) – 12.00 (Selling) – 11.87 (Mid-Rate)

- CBG Bank: 11.75 (Buying) – 12.15 (Selling) – 11.95 (Mid-Rate)

It is important to note that these exchange rates are subject to change and may vary depending on the time of day and market conditions. When engaging in currency exchange transactions, it is advisable to compare rates across different platforms to ensure you are receiving the most favourable exchange rate.

READ: Today’s Dollar, Pound and Euro To Cedi Exchange Rates

Dollar-to-Cedi Exchange Rates for November 23rd, 2023

| Name | Buying | Selling | MidRate | |

|---|---|---|---|---|

| Binance P2P Crypto Exchange | 12.20 | 12.20 | 12.20 | |

| WeWire Africa Fintech | 12.08 | 12.32 | 12.20 | |

| CediConvert Crypto Exchange | 12.04 | 12.39 | 12.21 | |

| GAFORB Forex Bureau | 12.00 | 12.25 | 12.12 | |

| AfriSwap Forex Bureau | 12.00 | 12.25 | 12.12 | |

| Express Forex Bureau | 12.00 | 12.25 | 12.12 | |

| Western Union Money Transfer | 11.80 | – | – | |

| Revolut Money Transfer | 11.78 | – | – | |

| GCB Bank Commercial Bank | 11.75 | 12.00 | 11.87 | |

| CBG Bank Commercial Bank | 11.75 | 12.15 | 11.95 |

The end of the year festive season in Ghana is a time for celebration and joy. However, it is also a time when the Ghanaian cedi tends to depreciate against the US dollar. This can have a number of negative consequences for the Ghanaian economy.

One of the main dangers of an increasing dollar-to-cedi exchange rate is that it can lead to inflation. This is because businesses often have to pay more for imported goods and services when the cedi depreciates. As a result, they may pass on these increased costs to consumers in the form of higher prices. This can make it more difficult for Ghanaians to afford basic necessities like food and fuel, and it can also erode their purchasing power.

Another danger of an increasing dollar-to-cedi exchange rate is that it can make it more difficult for Ghanaian businesses to export their goods and services. This is because exporters will receive fewer cedis for each dollar of revenue they earn. This can make it difficult for Ghanaian businesses to compete in the global market, and it can lead to job losses.

In addition, an increasing dollar-to-cedi exchange rate can also make it more difficult for the Ghanaian government to repay its debts. This is because the government often has to borrow in US dollars. When the cedi depreciates, the government has to pay more cedis to service its debt. This can put a strain on the government’s budget and make it more difficult to invest in essential public services like education and healthcare.

Finally, an increasing dollar-to-cedi exchange rate can also create uncertainty and instability in the Ghanaian economy. This can make it difficult for businesses to plan for the future and it can discourage investment.

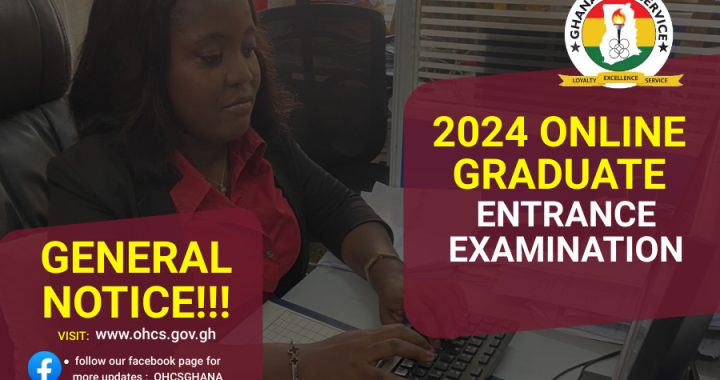

Civil Service Announces 2024 Online Examination Details for Graduate Applicants

Civil Service Announces 2024 Online Examination Details for Graduate Applicants  BREAKING: President Biden Announces Decision Not to Seek Reelection

BREAKING: President Biden Announces Decision Not to Seek Reelection  Real Reason Behind the Appointment of Yohunu as Deputy IGP

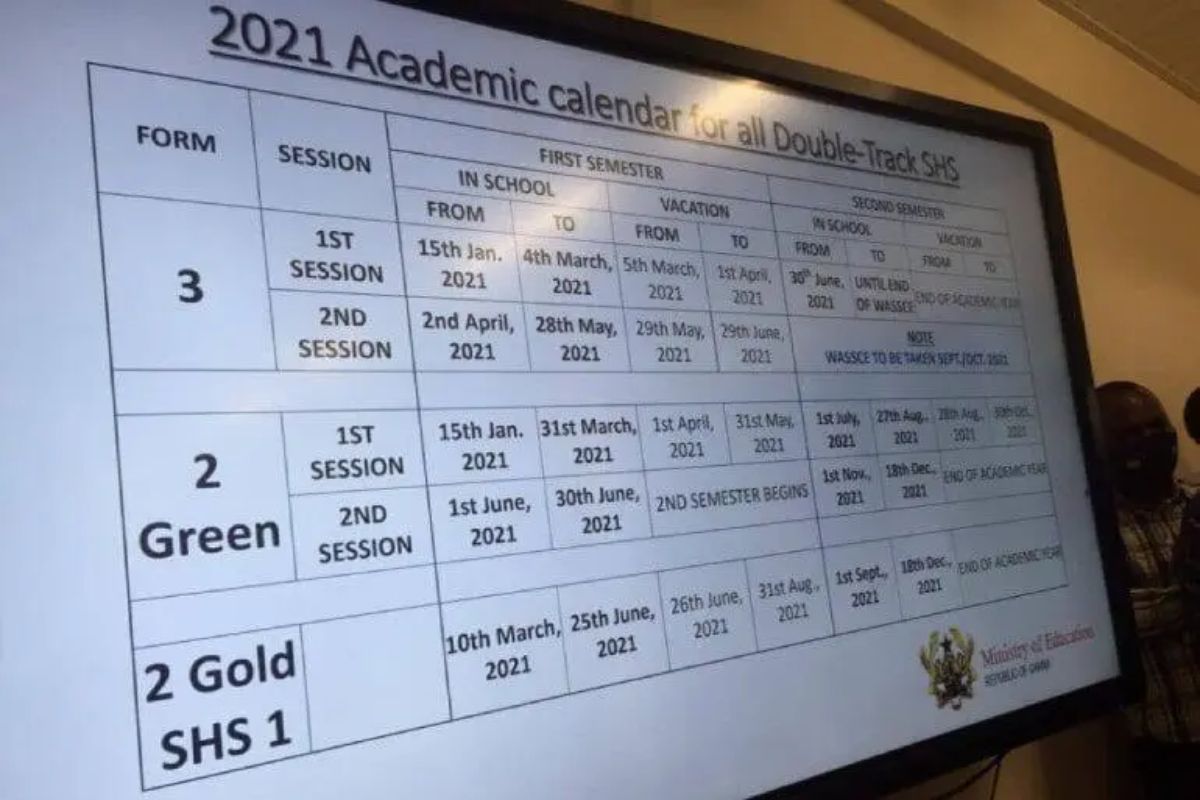

Real Reason Behind the Appointment of Yohunu as Deputy IGP  GES 2024-2025 Academic Calendar for Public Schools

GES 2024-2025 Academic Calendar for Public Schools  GES to recruit university graduates and diploma holders-GES Director General

GES to recruit university graduates and diploma holders-GES Director General  Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise

Dr. Bawumia’s Smart Phone Credit Will Take 125 Years To Repay: A Misleading Promise  GES is expected to announce reopening dates for public schools today

GES is expected to announce reopening dates for public schools today