Financial Planning: Five Practical Steps to Success

Financial Planning is for those who want to improve their financial standings and achieve great financial goals in the future. If you are one of such persons, then these Five Practical Steps to Success will help you in your financial plan activities from start to finish.

If you are looking forward to building a safe and sound financial independence, financial planning will be an important activity to engage in. Unfortunately, a lot of us feel we are not good enough to plan the financial future we desire. However, by following the five easy-to-follow steps shared in this financial education article, you can plan with less or no stress.

What is the Financial Planning Process?

Step 1: Know Your Current Financial State

To start your financial planning on a good note, you must know your current financial state by writing down your debt (those you owe that must be paid within one year and more), income (the money you have now and expect to earn) and expenses (bills you have to pay now and in future)

List the properties that help you make money (Assets). This includes

- The balance in your checking, savings, and money market accounts.

- Retirement savings.

- Stocks and bonds.

- The market value of your home and other properties.

Record your debts (those you owe that must be paid within one year and more) including:

- The balances on all credit cards.

- Student loan debt.

- Mortgage balance.

- Personal loan balances.

- Auto loans.

Sum up the total of your debts and assets then computer ASSETS-DEBTS figures. This will give you your net worth. If the answer you obtain is a negative balance, it simply means your current properties (Assets) cannot pay the people you owe if they all decide to come for the funds. This current information is not enough to help you plan completely so let us go on learning about financial planning.

You need to know the relationship between your income and expenses hence A second, equally important measure of financial standing can be found by looking at your income and expenses. Capture all your expenses:

- Debt payments.

- Utilities.

- Rent.

- Health bills

- Food and feeding-related expenses

- Transportation

Comparing your income and expenses provides your cash flow and insight into where your money is going. This serves as the foundation for creating your financial plan. Once you understand your current financial situation, you can plan for where you want to be.

READ: Financial planning for future income, expenses, savings and investments

Step Two: Set Your Goals

At this stage, you have to set your financial goals for the next one, two, or three years. The longer, the better, but you can have a long-term financial planning goal as well as short-term financial goals within the same plan. This goal should reflect your individual needs for the future. The goals set must meet the SMART criteria. Thus they must be Specific, Measurable, Achievable, Realistic and Time-bound

Some of the long-term and short-term financial goals in your plan may include the following

- You may plan to pay your debts.

- Build an emergency fund

- Save towards retirement.

- Plan your ward’s tertiary education funding needs

- Save towards building your dream house

- Save towards your mega marriage

- Start a business in future

Once you have been able to identify your future needs for which you are initiating the financial plan, arrange them according to their importance.

Take a good look at your current spending pattern and cut down wasteful expenses to save towards your financial plan and goal.

Increase your earnings or income or bring on board additional income sources to achieve your financial goals sooner. Understanding what it will take to achieve your financial goals allows you to make better financial decisions.

Step Three: Plan for the Future

Now that you are clear in your mind as to where you are now and where you want to be financial. Now, it is time you create a plan for achieving each of your financial goals.

For some, meeting financial goals will simply mean continuing on their existing path. For others, realizing financial goals will require a change in lifestyle or outlook.

For each of your financial goals, think about what it will take for you to achieve that goal.

For instance, saving for retirement takes place over several decades.

Making small investments over a longer period of time is often more advantageous than waiting and making larger contributions.

Look at your income and expenses. Chances are, there are some areas where you can reduce expenses in order to better allocate your funds.

Taking simple steps, like taking your lunch to work and cooking at home, can quickly add up.

Step Four: Managing Money

Savings for short-term goals, including paying off debt, can typically be done through savings accounts. However, long-term goals or goals that involve investing require other options for saving money. There are several ways to save and invest money. To determine which investment vehicle is best for your needs, consider the following:

- Risk Tolerance: Risk tolerance is a measurement of how comfortable you are risking your money in order to achieve greater returns in the future. There is no right amount of risk tolerance; it is dependent on your personality. Conservative individuals in the NYC area should invest in vehicles where the principal investment is likely to be maintained even if there is little to no growth. On the other hand, more aggressive investors will feel comfortable taking on riskier investments in order to receive larger rewards.

- Time Frame: The amount of time you have to invest can also determine an individual’s risk tolerance. For example, if funds are needed within the next year to two, a conservative option may be best in order to ensure funds will be available. Investments that will not be needed for an extended period of time can be more aggressively invested as there is time to make up for losses.

- Tax Implications: The type of investment selected can have a significant effect on income taxes. Therefore, it is important to consider your entire portfolio before deciding how to invest or save your money.

Step Five: Review Your Plan

Your financial plan should be a living document. Take time to regularly view your savings and investments to determine if they are on track for your savings goals. Consider if your current level of risk is providing the returns you’re expecting and make adjustments as necessary.

As your circumstances change, the financial plan should be updated. Designate a specific interval for reviewing your financial plan and determining where changes should be made. Additionally, reviews of your financial plan should take place when major life changes, such as marriage, having children or changing jobs, occur.

Send Stories | Social Media | Disclaimer

Send Stories and Articles for publication to [email protected]

We Are Active On Social Media

WhatsApp Channel: JOIN HERE

2024 BECE and WASSCE Channel - JOIN HERE

Facebook: JOIN HERE

Telegram: JOIN HERE

Twitter: FOLLOW US HERE

Instagram: FOLLOW US HERE

Disclaimer:

The information contained in this post on Ghana Education News is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Asogli State rejects renaming Ho Technical University after Ephriam Amu

Asogli State rejects renaming Ho Technical University after Ephriam Amu  KNUST Pro Vice-Chancellor makes donation of $10,000 To GReF

KNUST Pro Vice-Chancellor makes donation of $10,000 To GReF  Lydia Alhassan provides free transport for UG level 100 students

Lydia Alhassan provides free transport for UG level 100 students  How to buy UG Admission Voucher with Momo/Shortcode

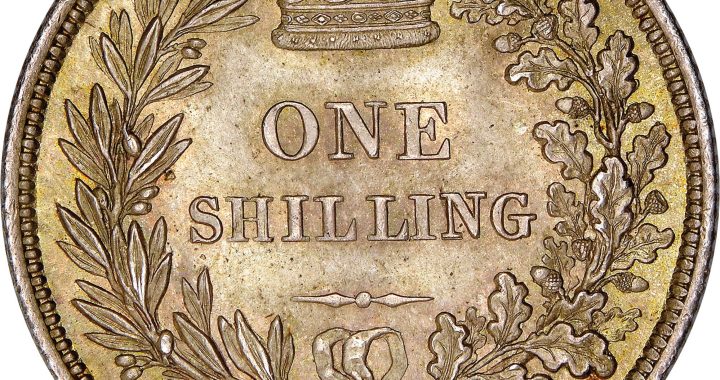

How to buy UG Admission Voucher with Momo/Shortcode  The Poll Tax Ordinance of 1852

The Poll Tax Ordinance of 1852  Top 5 Universities in the Netherlands for Masters Studies

Top 5 Universities in the Netherlands for Masters Studies