Financial planning for future income, expenses, savings and investments

Financial planning is the process of analyzing your current financial situation and creating a plan for future income, expenses, savings and investments. It’s about thinking about where you are today and where you want to be in the future. Financial planners help their clients make informed decisions on how to manage money now so they can reach specific financial goals.

Financial planning is not just for the rich or those who are going through a difficult time in life. Anyone who is willing to take control of their money, build wealth and pursue meaningful financial goals will benefit from speaking with a financial planner.

Even if you feel as though you are on top of your finances, speaking with a financial advisor can help you identify weaknesses in your strategy and come up with solutions that fit your personal needs.

Financial planning for future income, expenses, savings and investments

Why is Financial Planning Important?

Financial planning is the process of managing your money so you can reach your goals and feel secure about your future. When you’re financially prepared, you don’t have to worry about unexpected expenses derailing your savings, or not having enough money to cover life events like a new car, a wedding or a retirement.

Most people don’t have a financial plan in place, which is why so many don’t have enough money to cover their expenses.

Even if you think you’re on top of your finances, there’s a good chance you could be missing key pieces of your financial puzzle and you could be under-saving for your future.

A financial planner can help identify any weak spots in your strategy, and then come up with solutions to fix them.

How Do You Know If You Need Financial Planning?

It’s hard to know whether or not you need financial planning. The best way to gauge whether or not you would benefit from a financial planner is to take a look at your current financial situation.

If you can answer “yes” to any of the questions below, you may want to consider working with a financial advisor.

– Are you saving enough for retirement?

– Are you on track to pay off your student loan?

– Do you have an emergency fund?

– Are you taking advantage of your company’s 401(k) match?

– Do you want to minimize your taxes?

– Do you want to minimize the risk of outliving your money?

How to Find a Financial Planner?

When you’re ready to find a financial planner, start by doing some research. You should be able to find information on financial planners online and in your area. You can also ask friends and family members if they have suggestions.

You should also consider a few different factors when searching for a financial planner, including cost, credentials and experience.

Financial planners come in all shapes and sizes, and there are a few different types of people you can work with.

An accountant or financial advisor can help you with taxes, retirement savings and insurance, while a financial planner can help you set financial goals and come up with a strategy to achieve them.

Depending on what you need help with, each type of professional has different credentials.

Financial Planning Basics

– Estimate how much you’ll need for retirement.

– It’s hard to know exactly how much you’ll need in retirement, but one way to get a ballpark figure is to estimate how much you’ll need to cover your living expenses. Once you have a ballpark figure, you can figure out how much you need to save to reach that amount.

– Decide how you’ll pay for your retirement.

– You can save for retirement through your employer’s 401(k) plan, an individual retirement account (IRA) or a self-directed retirement account.

No matter which retirement account you choose, it’s important to contribute enough to get the full employer match.

If you’re offered free money, there’s no reason not to take it.

– Decide what you want to happen with your estate after you die.

– One of the biggest financial planning mistakes people make is not having a plan for their estate after they die.

You should have a general idea of whom you want to inherit your assets and how you want those assets distributed.

– Decide if and when you’ll be a parent. – If you’re thinking about having a child, you should sit down with a financial planner to see how the cost of raising a child will affect your finances. You should also make sure you have enough life insurance in case something happens to you.

– If you’re in debt, you need to figure out a way to pay it off as quickly as possible. If you have savings, you should try to increase your savings rate. And if you have investments, you should carefully analyze your portfolio to make sure it’s right for your goals and risk tolerance.

READ: 12 Personal & Business Financial Rules You Must Never Break

Conclusion

Financial planning is essential to achieving financial security and creating a comfortable life for yourself and your family. Financial planning is a process that involves setting financial goals and creating a plan to meet those goals. A financial planner can help you develop a financial plan that will help you meet your goals. The benefits of financial planning include improving your quality of life, setting yourself up for financial success and feeling more secure about your future.

Send Stories | Social Media | Disclaimer

Send Stories and Articles for publication to [email protected]

We Are Active On Social Media

WhatsApp Channel: JOIN HERE

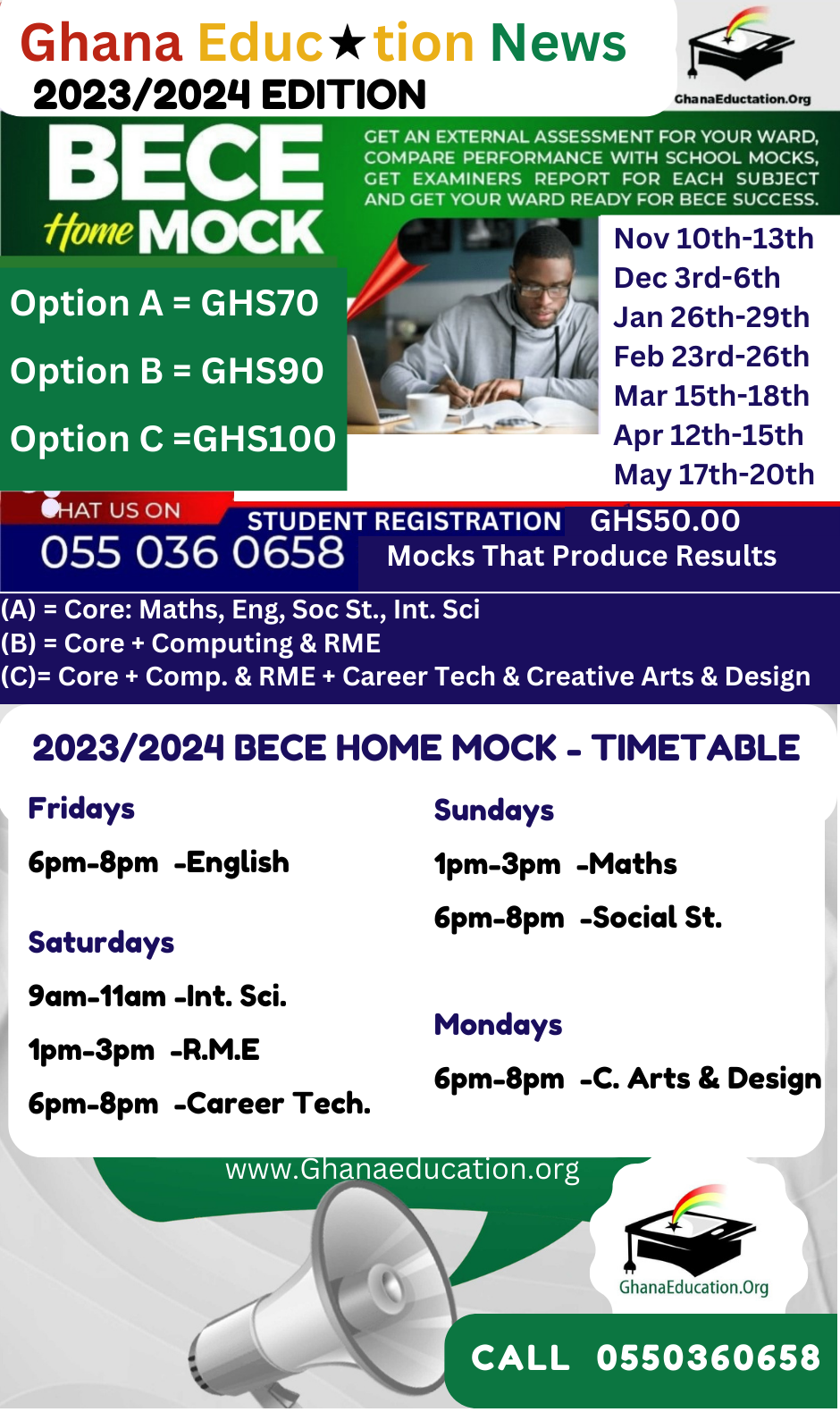

2024 BECE and WASSCE Channel - JOIN HERE

Facebook: JOIN HERE

Telegram: JOIN HERE

Twitter: FOLLOW US HERE

Instagram: FOLLOW US HERE

Disclaimer:

The information contained in this post on Ghana Education News is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Asogli State rejects renaming Ho Technical University after Ephriam Amu

Asogli State rejects renaming Ho Technical University after Ephriam Amu  KNUST Pro Vice-Chancellor makes donation of $10,000 To GReF

KNUST Pro Vice-Chancellor makes donation of $10,000 To GReF  Lydia Alhassan provides free transport for UG level 100 students

Lydia Alhassan provides free transport for UG level 100 students  How to buy UG Admission Voucher with Momo/Shortcode

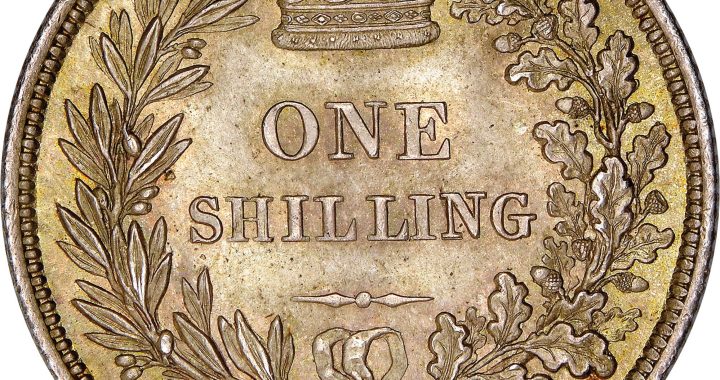

How to buy UG Admission Voucher with Momo/Shortcode  The Poll Tax Ordinance of 1852

The Poll Tax Ordinance of 1852  Top 5 Universities in the Netherlands for Masters Studies

Top 5 Universities in the Netherlands for Masters Studies