Government Settles $709M Eurobond Debt; Total 2025 Payments Hit $1.4B

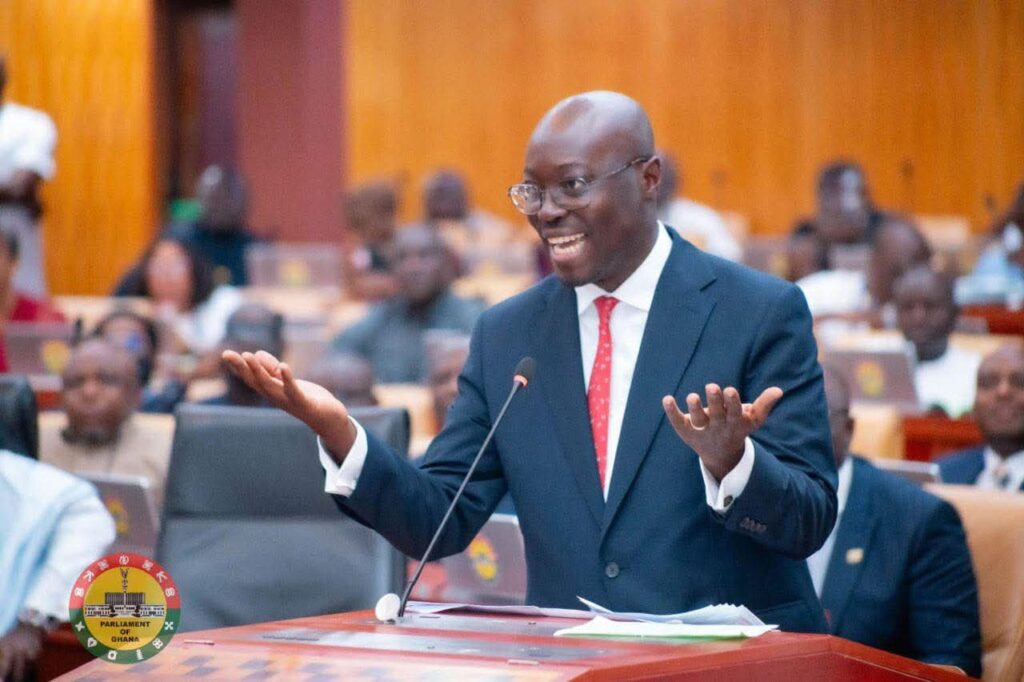

The Ministry of Finance has successfully settled a US$709 million Eurobond obligation on 30th December 2025, ahead of its due date, marking another significant milestone in Ghana’s economic recovery and debt-management efforts. This was announced by Hon. Cassel Ato Forson, Minister of Finance.

This brings total payments in 2025 alone to US$1.4 billion to Eurobond holders under the restructuring memorandum, comprising payments of US$349.52 million, US$349.52 million, and US$709.00 million.

The timely settlement reaffirms Ghana’s credibility as a sovereign borrower and underscores Government’s commitment to restoring investor confidence through transparent, predictable, and disciplined debt-service practices.

Building on this achievement, Government will intensify reforms in domestic revenue mobilisation, public financial management, and public debt management.

Fiscal buffers will continue to be strengthened to support debt-service obligations and sustainably finance Ghana’s development agenda.

Government thanks the good people of Ghana for their support and understanding, which have been vital to the country’s economic recovery. We also take this opportunity to appeal for continued forbearance and cooperation as further economic reforms are implemented in the coming year to consolidate the gains achieved in 2025.

1. Analysis of Ghana’s Debt-to-GDP Strategy

This strategic early settlement of $709 million is a critical indicator of Ghana’s improving fiscal health. By meeting these obligations ahead of schedule, the Ministry of Finance is actively reducing the “sovereign risk” premium often associated with West African markets. From a debt-management perspective, this move signals to global rating agencies—such as Moody’s and Fitch—that Ghana’s debt-restructuring memorandum is not just a plan on paper, but a functional framework delivering tangible results in the post-DDEP (Domestic Debt Exchange Programme) era.

2. Expert Insight: Restoring Market Access

Education and finance analysts observe that the consistency of these payments—totaling $1.4 billion in 2025—is essential for Ghana’s eventual return to the international capital markets. For the average Ghanaian, this discipline translates into a more stable exchange rate and controlled inflation. By prioritizing transparent debt-servicing, the government is effectively “clearing the path” for cheaper credit in the future, which is vital for funding national infrastructure and education projects without increasing the tax burden on citizens.

3. Future Outlook: Beyond the 2025 Fiscal Year

As we transition into 2026, the focus must remain on the government’s commitment to “disciplined debt-service practices.” The success of this Eurobond settlement hinges on the promised intensification of domestic revenue mobilization. Stakeholders should look for continued transparency in public financial management as the primary safeguard against the fiscal slippage often seen in election-adjacent years. This achievement provides a solid buffer, but sustainable growth will require maintaining this “fiscal discipline” across all sectors of the economy.

Terrorist Attack Ghanaian Tomato Traders in Burkina Faso

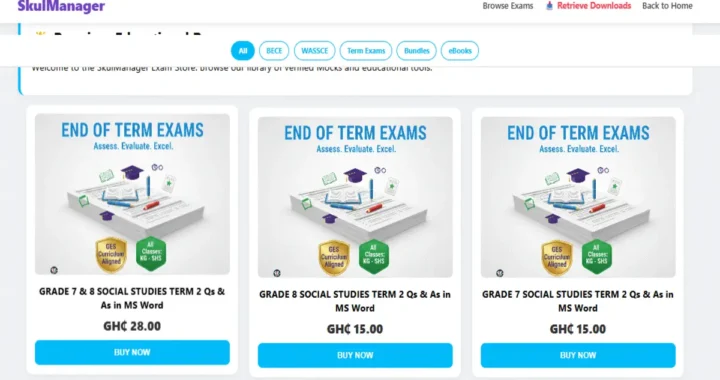

Terrorist Attack Ghanaian Tomato Traders in Burkina Faso  New Term 2 End of Term Question: Nursery to Grade 8 Exam Packs (2026)

New Term 2 End of Term Question: Nursery to Grade 8 Exam Packs (2026)  Why MTN Ghana’s Ghs399 Bundle is the Best Data Deal in 2026

Why MTN Ghana’s Ghs399 Bundle is the Best Data Deal in 2026  CAGD Salary Suspension 2026: Deadlines and Actions for Affected Staff

CAGD Salary Suspension 2026: Deadlines and Actions for Affected Staff