Teachers’ Fund Announces Temporary Drop in Loan Affordability: What Educators Need to Know

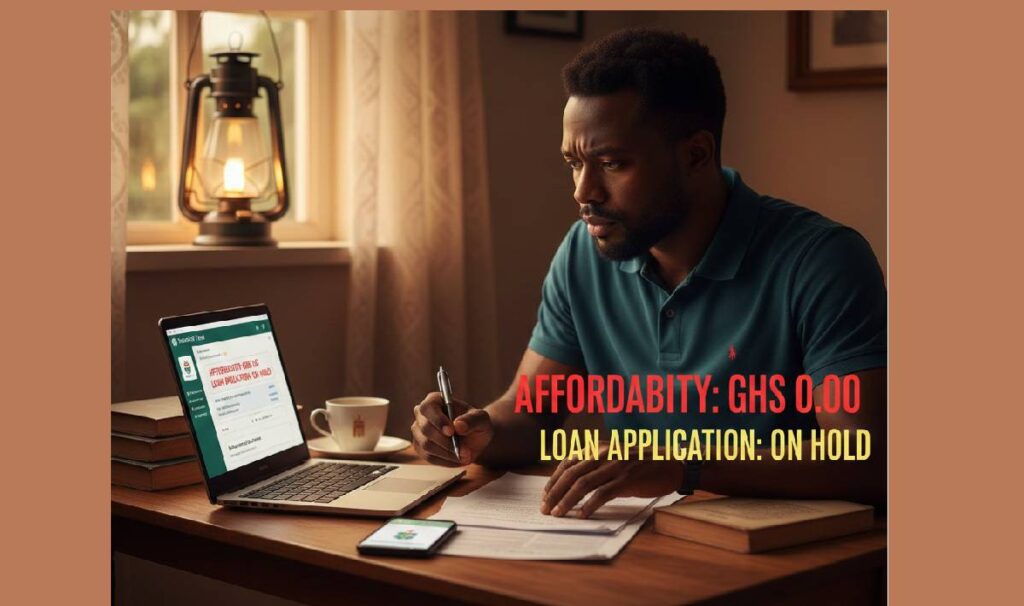

In a recent administrative notice dated 31st December 2025, the Teachers’ Fund has officially alerted its members across the country regarding a significant drop in loan affordability. This development has left many educators concerned, especially those with pending loan applications intended for the end-of-year period. Teachers can also calculate their affordability right in this post. Let’s break the unfortunate issue down.

The management of the Fund has cited specific payroll deductions as the primary cause for this sudden shift in financial eligibility.

Why Teachers’ Affordability Temporarily Dropped

The Cause: NTC and Professional Development Deductions

The reduction in affordability is primarily attributed to the statutory deductions for Teachers’ Professional Development and the National Teaching Council (NTC) Teacher License fees. These deductions were fully factored into the December 2025 affordability calculations, effectively reducing the net “disposable” income used to determine how much a teacher can borrow.

For many members, these deductions have pushed their debt-to-income ratio to the limit. In several instances, this has resulted in “zero affordability,” meaning the applicant currently does not have enough remaining salary to cover the monthly repayments of a new loan.

Impact on Pending Loan Applications

If you currently have a loan application in the system, here is how this notice affects you:

- Reduced Loan Amounts: Some applicants who previously qualified for a specific amount may find that they now only qualify for a much smaller sum.

- Applications on Hold: To protect members from over-borrowing and to ensure compliance with financial regulations, the Teachers’ Fund has placed a temporary hold on the processing of all affected loan applications.

- Automatic Rejection Prevention: Rather than rejecting applications outright due to the December payroll “anomaly,” the Fund is holding them until the financial data stabilizes.

The Solution: January 2026 Correction

The Teachers’ Fund has assured members that this is a temporary setback. The issue is expected to be corrected immediately following the January 2026 payroll run.

Once the one-time license fees and specific professional development deductions have been processed and the system resets for the new year, affordability levels are expected to return to normal. Processing for all affected applications will resume during the January 2026 payroll window.

Action Steps for Teachers

Management has directed all District Secretaries to disseminate this information to ensure that applicants at the local level are well-informed.

- Be Patient: Avoid resubmitting applications immediately; wait for the January window as advised.

- Check Your Payslip: Review your December 2025 E-payslip to understand exactly how the NTC and Professional Development fees impacted your net salary.

- Consult Your District Office: If you have an urgent financial need, speak with your District Secretary for further guidance on the status of your specific application.

READ: Ghana ranked most educated country in West Africa by UNESCO

Stay tuned to this portal for further updates on the Teachers’ Fund and GES payroll news.

📊 Loan Affordability Calculator

Based on the GES/CAGD 40% Net Salary Policy

*Disclaimer: This is an estimate. Final affordability is determined by CAGD and the Teachers’ Fund.*

How to Find Your Calculation Figures on the E-Payslip

Before using the calculator, log in to the CAGD E-payslip portal and locate these specific fields:

1. Gross Salary

This is your total earnings before anything is taken out.

- Where to find it: Look at the top right or bottom of the "Earnings" column.

- Note: It includes your basic salary plus all allowances (Market Premium, Rent, Retention, etc.).

2. Total Deductions

This is the sum of everything being removed from your pay.

- Where to find it: Look at the bottom of the "Deductions" column.

- What it includes: Income Tax (PAYE), SSNIT, Union Dues, Mutual Funds, and any existing bank or Teachers' Fund loans.

Understanding the 40% Net Salary Rule

The Government of Ghana policy (CAGD) ensures that no worker is "over-borrowed." The system is programmed to protect at least 40% of your Gross Salary as your "Take Home Pay."

Example: If your Gross Salary is GHS 5,000, your total deductions (Loans + Taxes + Fund) cannot exceed GHS 3,000 (which is 60%). The system must leave you with at least GHS 2,000 (which is 40%).

Why December Looked Different and Teachers' Fund Loan Affordability Dropped

On your December 2025 payslip, you likely noticed two extra deductions:

- NTC License Fee: A statutory fee for your teaching license.

- CPD Deduction: Fees for Professional Development.

Because these were added to your Total Deductions, they reduced the remaining "space" or "affordability" you had for a loan. If your deductions already totaled 59% of your gross, these extra fees pushed you over 60%, resulting in Zero Affordability.

Summary for January 2026

Once the January payroll runs, these one-time fees (NTC/CPD) will fall off. Your Total Deductions figure will decrease, and your Affordability will automatically increase.

Pro-Tip: Always check your "Affordability" on the E-payslip portal itself under the "Loan" tab before visiting the bank or the Teachers' Fund office.

Terrorist Attack Ghanaian Tomato Traders in Burkina Faso

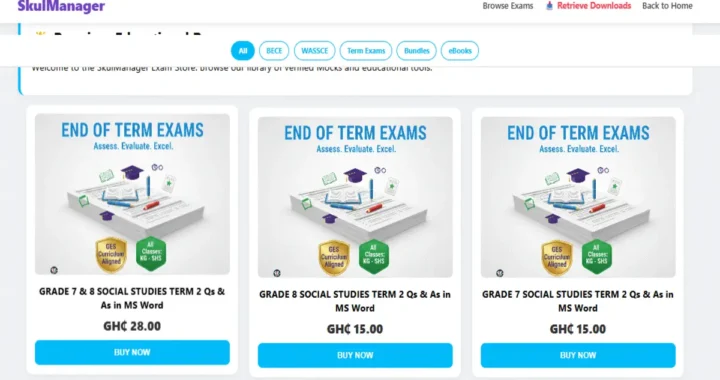

Terrorist Attack Ghanaian Tomato Traders in Burkina Faso  New Term 2 End of Term Question: Nursery to Grade 8 Exam Packs (2026)

New Term 2 End of Term Question: Nursery to Grade 8 Exam Packs (2026)  Why MTN Ghana’s Ghs399 Bundle is the Best Data Deal in 2026

Why MTN Ghana’s Ghs399 Bundle is the Best Data Deal in 2026  CAGD Salary Suspension 2026: Deadlines and Actions for Affected Staff

CAGD Salary Suspension 2026: Deadlines and Actions for Affected Staff