Mastercard ends Binance card partnership in latest blow to crypto giant

Mastercard ends Binance card partnership in latest blow to crypto giant

Embattled cryptocurrency exchange Binance has lost some business with payment card networks Mastercard and Visa.

The development is a sign of how traditional financial institutions are growing wary of working with the company as it faces intense regulatory scrutiny and wider concerns around financial compliance within the crypto industry.

Mastercard will soon no longer offer Binance-branded cards in Latin America and the Middle East, which let customers user their crypto to purchase goods, Binance said Thursday via X, the company formerly known as Twitter.

“The product, like most debit cards, has been utilized by Binance’s users to pay for basic daily expenses but in this case, the cards are funded with crypto assets,” Binance Customer Support said on Twitter.

“Only a tiny portion of our users (less than 1% of users in the markets mentioned) are impacted by this. Users of this product will have until September 21, 2023, when the card will no longer be available for use.”

“Binance accounts around the world are not affected. Where available, users can also shop with crypto and send crypto using Binance Pay, a contactless, borderless and secure cryptocurrency payment technology designed by Binance,” the company added.

Mastercard confirmed that it is ending the partnership, with a spokesperson from Sept. 22, four pilot Binance co-branded Mastercard card programs the company had with Binance in Argentina, Brazil, Colombia and Bahrain “will no longer be in use.”

“This provides cardholders with a wind-down period to convert any holdings in their Binance wallet,” the Mastercard spokesperson said. “There is no impact on any other crypto card program.”

Visa, meanwhile, also moved to distance itself from Binance. The company ended a similar card tie-up with Binance, as it ceased issuing new co-branded cards with the firm in Europe as of July, a spokesperson for the company told Bloomberg.

It’s a sign of how crypto continues to face a broadly tepid response from the financial services industry.

Backlash

Mastercard had warmed to crypto in recent years. In Oct. 2021, the firm began allowing any bank or merchant the ability to offer crypto services. Last year, the company launched a product allowing banks to assess the risk of crime posed by crypto merchants, and started letting banks offer crypto trading.

For its part, Mastercard said its decision to end the tie-up with Binance has “no impact on our wider commitment to enabling and securing digital assets, which we continue to support.”

Binance faces intense backlash from regulators including the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission.

The SEC brought 13 charges against Binance and its CEO Changpeng Zhao accusing the company of commingling billions of dollars in customer money with Binance’s own funds, similar to allegations made against the now bankrupt crypto exchange FTX.

Binance denies the allegations.

The firm recently filed a protective order against the SEC, saying the regulator’s requests for information were “over broad” and “unduly burdensome.”

Last week, Checkout.com reportedly dropped Binance as a customer, citing “reports of regulators actions and orders in relevant jurisdictions,” “inquiries from partners,” and concerns over the firm’s anti-money laundering, sanctions and compliance controls.

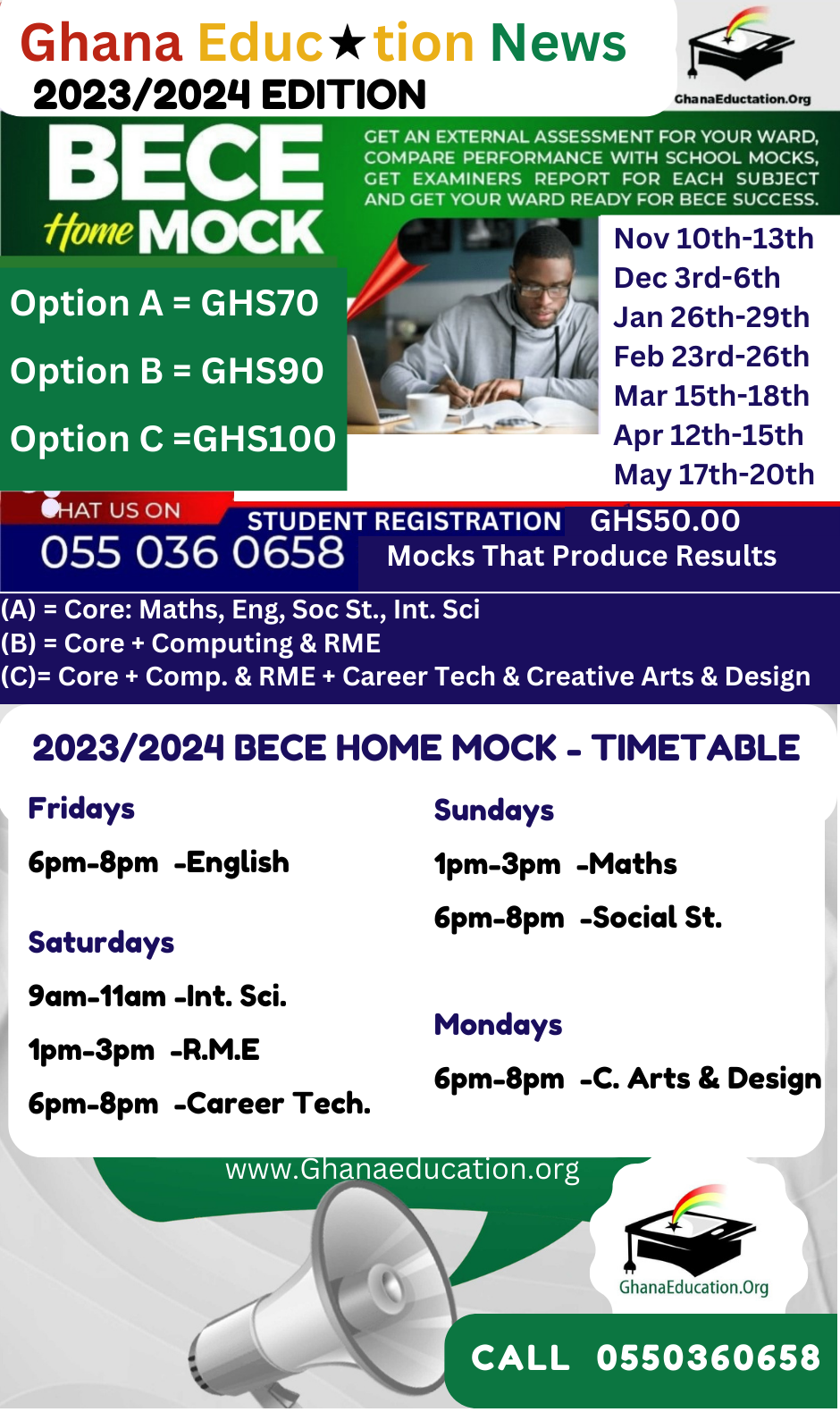

Send Stories | Social Media | Disclaimer

Send Stories and Articles for publication to [email protected]

We Are Active On Social Media

WhatsApp Channel: JOIN HERE

2024 BECE and WASSCE Channel - JOIN HERE

Facebook: JOIN HERE

Telegram: JOIN HERE

Twitter: FOLLOW US HERE

Instagram: FOLLOW US HERE

Disclaimer:

The information contained in this post on Ghana Education News is for general information purposes only. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

Profile Of Kwabena Boateng, Ejisu MP Elect

Profile Of Kwabena Boateng, Ejisu MP Elect  KNUST student honoured at International Sports Media Awards (AIPS)

KNUST student honoured at International Sports Media Awards (AIPS)  GNAPS calls for urgent subsidy of BECE charges for private schools

GNAPS calls for urgent subsidy of BECE charges for private schools  Ministry of Education Denies Rebranding of Basic Schools

Ministry of Education Denies Rebranding of Basic Schools  GNPC Opens 2024 Scholarships Portal For New Applicants

GNPC Opens 2024 Scholarships Portal For New Applicants